A free market is an economic system in which the prices for goods and services are self-regulated by the open market and by consumers. In a free market, the laws and forces of supply and demand are free from any intervention by a government or other authority and from all forms of economic privilege, monopolies, and artificial scarcities. This article will delve into its core definition, essential characteristics, significant advantages and disadvantages, and its profound impact on the world of business.

This article outlines the key principles of the free market to help businesses and investors gain a clearer understanding of how it drives competition, innovation, and growth. We specialize in company formation and do not provide financial or investment advice. For regulatory or compliance matters, please consult a qualified expert or relevant authority.

What is a free market?

A free market is an economic system where prices for goods and services are determined by the forces of supply and demand, with minimal or no direct government intervention in pricing and production decisions, although the government may still enforce property rights and contracts. This system is fundamentally built upon the principle of voluntary exchange, where willing buyers and sellers freely engage in transactions under competitive conditions and with free access to relevant market information. If a seller sets a price too high, a consumer can choose to purchase from another seller offering a lower price, or not at all. This dynamic interaction is what naturally establishes the market price and the quantity of goods produced.

The guiding force behind this seemingly uncoordinated system was famously termed the "invisible hand" by the 18th-century Scottish economist, Adam Smith. Smith's theory posits that when individuals act in their own self-interest - producers seeking to maximize profit and consumers seeking the best value - they inadvertently contribute to the economic well-being of society as a whole. The pursuit of individual gain leads to a competitive environment that results in the efficient allocation of resources, innovation, and fair prices, as if guided by an unseen force.

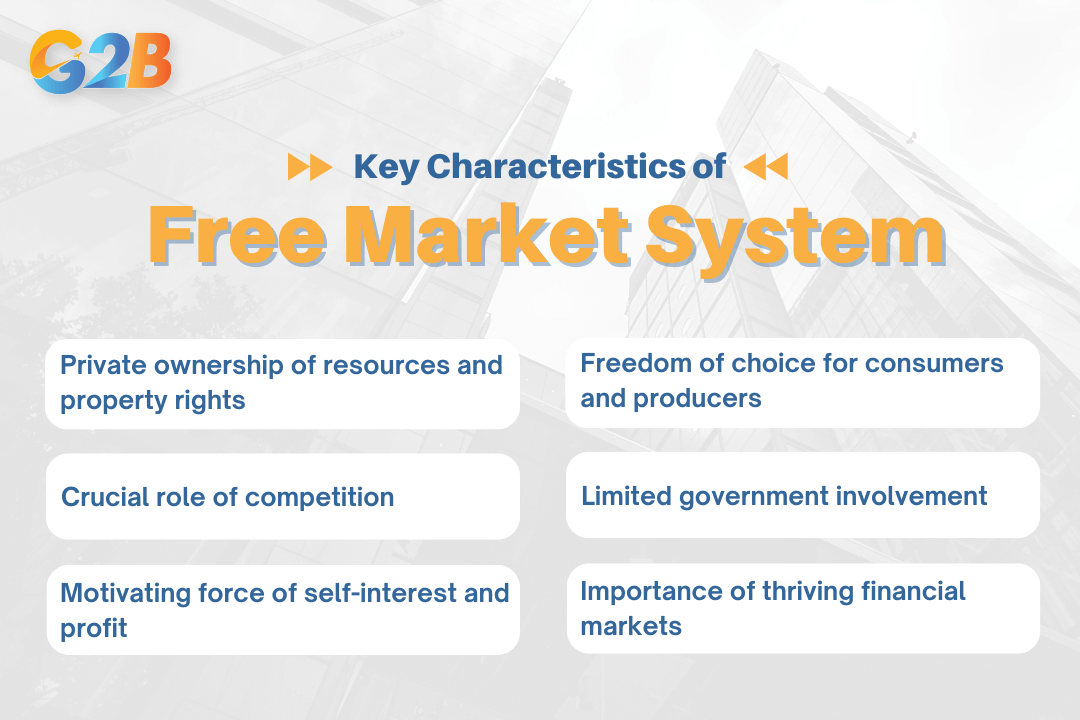

Key characteristics of a free market system

Several defining features distinguish a free market economy and enable it to function. These characteristics create an environment of economic liberty and competition that shapes all business and consumer activity.

Several features distinguish a free market economy and enable it to function

Private ownership of resources and property rights

In a free market, the means of production - such as land, factories, and capital - are owned by private individuals and entities, not the government. This private ownership is protected by a strong legal framework of property rights. The legal right to own, use, and dispose of property provides a powerful incentive for individuals and businesses to invest, take risks, and use their resources efficiently. Without secure property rights, the motivation to accumulate and improve assets would be severely diminished, hindering economic activity.

Freedom of choice for consumers and producers

A core tenet of the free market is the freedom of individuals to make their own economic decisions. Consumers are free to choose which goods and services to buy, and from whom. Simultaneously, producers have the liberty to decide what to sell, in what quantity, and how to produce it. This mutual freedom creates a dynamic marketplace where businesses must compete to attract customers by offering better products, lower prices, or superior service. This competition is a primary engine of innovation and quality improvement.

Motivating force of self-interest and profit

The pursuit of self-interest is the primary driver of economic activity in a free market. For businesses, this translates to the profit motive. The desire to generate profits incentivizes entrepreneurs to produce goods and services that consumers demand. This relentless drive for profit ensures that resources are channeled toward producing what society values most. If a product is in high demand, its price and potential for profit will rise, encouraging more businesses to enter that market until the demand is met.

Crucial role of competition

Competition is the regulatory mechanism of the free market. The rivalry among businesses for consumer dollars leads to numerous benefits for society. It pushes prices down as firms seek to offer more attractive deals than their rivals. It also forces companies to improve the quality of their products and to innovate to gain a competitive edge. A market with robust competition offers consumers a wider variety of choices and ensures that businesses operate efficiently to keep their costs low.

Limited government involvement

The ideal free market operates under the principle of laissez-faire, where the government's role is intentionally minimal. In this view, government intervention through taxes, subsidies, or regulations can distort the natural price signals of the market, leading to inefficiencies. The government’s essential functions are typically restricted to foundational duties such as enforcing contracts, protecting private property, providing national defense, and maintaining a stable currency.

Importance of thriving financial markets

For a free market to operate effectively, it requires a well-developed financial sector, including banks, stock markets, and other financial institutions. These markets play a critical role in facilitating economic activity by channeling savings and investment between different players. They provide the necessary capital for entrepreneurs to start new businesses and for existing companies to invest, grow, and expand their operations, fueling the cycle of economic growth.

Advantages of a free market economy

The principles of the free market, when put into practice, can yield significant benefits for an economy and its participants, fostering an environment of dynamism and opportunity.

The principles of the free market bring significant benefits

Fostering innovation and economic growth

The competitive and profit-driven nature of a free market creates a powerful incentive for innovation. To gain a market advantage and increase profits, businesses must constantly seek new and better ways to create products, improve processes, and meet consumer needs. This environment of constant improvement and entrepreneurial activity is strongly linked to higher rates of economic growth, as new ideas and technologies drive productivity and create wealth.

Efficient allocation of resources

One of the most celebrated advantages of the free market is its ability to allocate resources efficiently. The price mechanism acts as a powerful signaling system. When demand for a product increases, its price rises, signaling to producers that there is an opportunity for profit. They then shift resources - capital, labor, and raw materials - into producing more of that good. This process, known as allocative efficiency, ensures that resources are naturally directed to their most valued uses, directly aligning production with consumer preferences without the need for central planning.

Consumer sovereignty and increased choice

In a free market, the consumer is king. This principle is known as "consumer sovereignty", which means that consumer preferences and purchasing decisions ultimately determine which products and businesses succeed or fail. Producers must respond to the demands of consumers or risk being driven out of business by competitors. A direct and highly visible result of this dynamic is the vast array of goods and services available to consumers, catering to a wide spectrum of tastes, needs, and price points.

Economic freedom and individual opportunity

The free market provides a high degree of economic freedom, empowering individuals to make their own choices about their careers, investments, and business ventures. This environment creates significant opportunities for upward economic mobility and wealth creation. Anyone with an innovative idea and the willingness to take risks has the opportunity to start a business and pursue economic success, regardless of their background.

The drive for efficiency and lower prices

Intense competition acts as a constant pressure on businesses to be as efficient as possible. To maintain profitability, especially in markets with many rivals, companies must continually find ways to reduce their production costs. This focus on operational efficiency often translates into more competitive prices for consumers, as cost savings are passed on to maintain or grow market share.

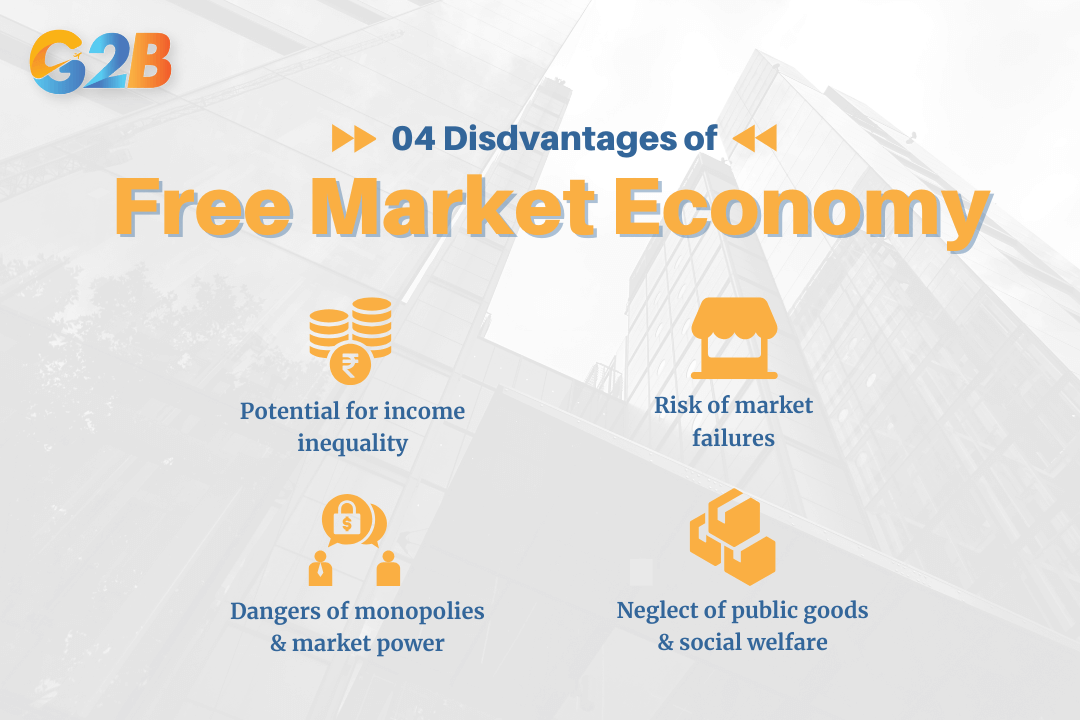

Disadvantages of a free market

While the free market is a powerful engine for growth and innovation, it is not without significant drawbacks. Its unregulated nature can lead to undesirable social and economic outcomes that often necessitate some form of intervention.

There are seven disadvantages of a free market

Potential for income inequality

One of the most significant criticisms of a pure free market system is its potential to create a substantial gap between the rich and the poor. Without government intervention through mechanisms like progressive taxation or social safety nets, wealth can become highly concentrated. Factors such as disparities in skills, education, access to capital, and inherited wealth can lead to vastly different economic outcomes, resulting in significant income inequality.

Risk of market failures

A market failure is a situation where the free market, left to its own devices, fails to allocate resources efficiently, leading to a net loss for society. These failures represent cases where the pursuit of private self-interest does not lead to a socially optimal outcome. There are several well-recognized types of market failures.

Externalities

An externality is a cost or benefit that affects a third party who did not choose to incur that cost or benefit. The classic example of a negative externality is pollution. A factory may produce goods and sell them at a price that reflects its private costs of production (labor, materials), but it does not account for the societal cost of the pollution it releases, which can harm the environment and public health. Because this cost is not included in the market price, the factory may produce more of its product than is socially desirable.

Public goods and the free-rider problem

Public goods are services that are non-excludable and non-rivalrous. Non-excludable means it is not feasible to prevent someone from using the good, and non-rivalrous means one person's use does not diminish another's ability to use it. Classic examples include national defense, streetlights, and fresh air. The free market often underproduces these goods due to the free-rider problem. This occurs when individuals can benefit from a good or service without paying for it. Since private companies cannot easily charge individuals for their use, there is little profit incentive to provide them in the first place, leading to a market failure.

Information asymmetry

Information asymmetry occurs when one party in an economic transaction possesses more or better information than the other party. This imbalance can lead to inefficient outcomes and exploitation. For example, a used car seller may know about a vehicle's hidden defects that the buyer does not. Without this information, the buyer may pay more for the car than it is worth. This can erode trust in the market and prevent mutually beneficial transactions from occurring.

The dangers of monopolies and market power

While competition is a hallmark of the free market, unchecked competition can paradoxically lead to its opposite: the rise of monopolies (a single seller) or oligopolies (a few dominant sellers). A successful company may drive all its competitors out of business or acquire them, leading to concentrated market power. This allows the dominant firm to artificially raise prices, reduce output, and stifle innovation, as it no longer faces competitive pressure to do otherwise.

The neglect of public goods and social welfare

The profit motive, while excellent at driving the production of consumer goods, can lead to the underinvestment in areas with significant social benefits but low profitability. Services such as education, preventative healthcare, and basic research may not be adequately provided by the private market alone. Furthermore, a pure free market does not inherently provide social safety nets for the elderly, unemployed, or disabled, which can leave vulnerable populations without support.

Role of government in a "free" market

While the term "free market" implies an absence of government, in practice, even the most market-oriented economies rely on government to perform several crucial functions. Rather than controlling the market, these roles are designed to support it, ensure its fairness, and correct its inherent weaknesses.

Enforcing property rights and contracts

The most fundamental role of government in a market economy is to provide a legal framework that protects private property and ensures contracts are legally binding and enforceable. Without a reliable legal system to uphold these rights, individuals and businesses would lack the confidence to engage in transactions, make investments, or lend money, bringing economic activity to a halt.

Ensuring a level playing field

To prevent the formation of monopolies and protect the competitive nature of the market, governments often implement antitrust laws. These laws are designed to prohibit business practices that unreasonably restrain trade and promote fair competition. Additionally, regulations are put in place to prevent unfair or deceptive practices, such as false advertising or fraud, which helps maintain consumer trust in the market.

Addressing market failures and externalities

Governments frequently intervene to correct market failures. To address externalities like pollution, a government might impose taxes on the polluting activity (a "Pigouvian tax") to internalize the external cost or implement regulations that limit emissions. To solve the underproduction of public goods, governments often fund them directly through taxation, ensuring services like national defense and infrastructure are provided for the collective benefit.

Providing a stable legal and monetary framework

A stable and predictable environment is essential for a thriving economy. A key role of government is to maintain the stability of the nation's currency and control inflation. A stable monetary framework, combined with a predictable legal and regulatory system, gives businesses the confidence they need to make long-term investments and plan for the future, fostering sustainable economic growth.

Impact of the free market on business

The free market system creates a dynamic and demanding environment for businesses:

- On one hand, the free market offers unparalleled opportunities for entrepreneurship, innovation, and high profits. Businesses have the freedom to identify a consumer need and create a product to meet it, with the potential for substantial financial rewards. The profit motive encourages efficiency and creativity, pushing companies to perform at their best.

- On the other hand, this environment is characterized by constant competitive pressure and a high risk of failure. Businesses must remain agile, efficient, and responsive to consumer demands. A failure to innovate or control costs can quickly lead to a loss of market share to more adept competitors. Therefore, for businesses to succeed, a deep understanding of market trends, supply and demand dynamics, and consumer behavior is absolutely critical.

Free market vs. Other economic systems

The principles of the free market are best understood when contrasted with other major economic systems. The primary points of comparison are the command economy and the mixed economy.

Free market vs. Command economy

A command economy is a system where the government centrally plans and controls all major aspects of economic activity. In this system, the government - not market forces - decides what goods are produced, how they are produced, and at what prices they are sold. Ownership of resources and major industries resides with the state. This is in direct contrast to the free market's emphasis on private ownership, individual choice, and decentralized decision-making. Command economies often suffer from inefficiencies and inflexibility due to centralized planning. Historical and present-day examples of command economies include the former Soviet Union, North Korea, and Cuba.

Free market vs. Mixed economy

A mixed economy is a hybrid system that blends elements of a free market with government intervention. This is the most common economic system in the world today, with nearly every major economy, including the United States, operating as a mixed economy. A mixed economy seeks to harness the advantages of the free market - such as innovation, efficiency, and consumer choice - while using government intervention to mitigate its disadvantages. This intervention includes providing public goods, regulating key industries, enforcing environmental protections, and creating social safety nets to reduce inequality. Moreover, government involvement helps protect public interests and promote sustainable development.

The free market stands as a powerful engine for economic growth and innovation, fundamentally driven by the principles of individual freedom, competition, and self-interest. For entrepreneurs aiming to register a company in Vietnam, this system provides both opportunities and challenges shaped by market dynamics and regulatory frameworks.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom