Free Carrier (FCA) is a highly flexible and commonly used Incoterm established by the International Chamber of Commerce (ICC) to govern international trade. It defines the specific responsibilities, risks, and costs shared between a seller and a buyer, ensuring clarity in global transactions. This guide breaks down everything about FCA, including seller and buyer obligations, key advantages, and how it compares to other Incoterms.

This article provides readers with a clearer understanding of Free Carrier. We specialize in company formation and do not offer financial or investment advisory services. For detailed investment guidance, please consult a qualified financial expert.

What is free carrier (FCA)?

Free Carrier (FCA) is an international trade term that dictates the seller is responsible for delivering goods to a carrier at a specified location. This "named place" is a critical component of the FCA rule, as it marks the exact point where the risk of loss or damage transfers from the seller to the buyer. The seller must arrange for the goods to be cleared for export. From the moment the goods are handed over to the buyer's nominated carrier, the buyer assumes all subsequent responsibilities and costs.

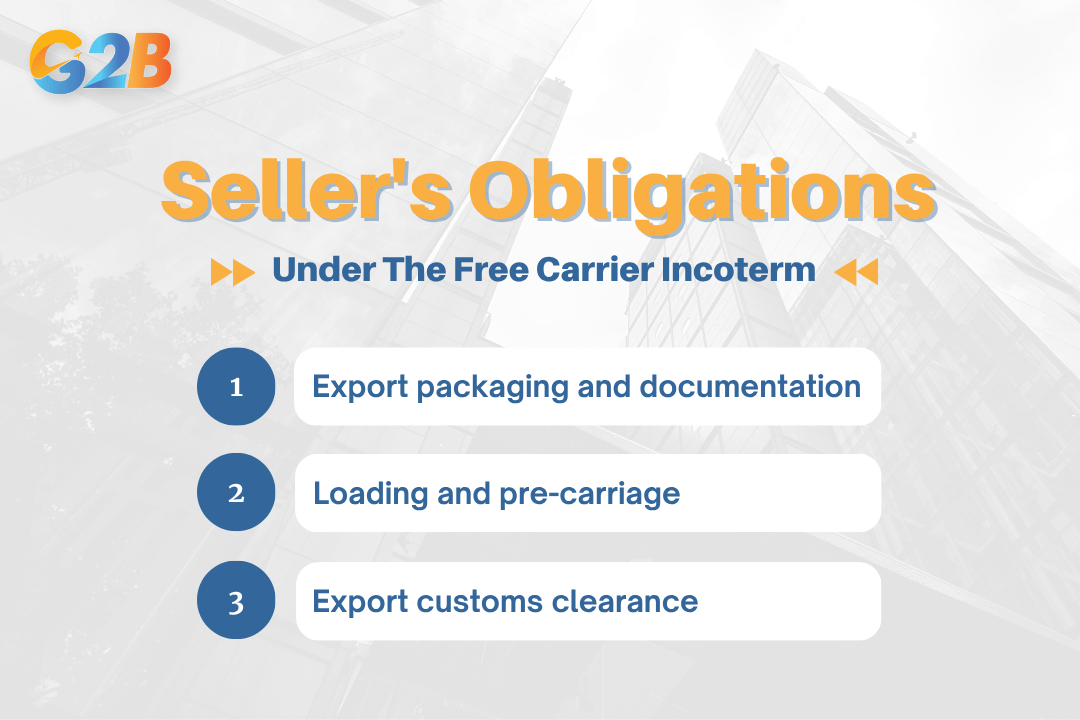

The seller's obligations under FCA

Under the Free Carrier Incoterm, the seller has a clear set of responsibilities that extend up to the point of handover at the named place. Fulfilling these obligations correctly is essential for a smooth transaction and to ensure the risk is properly transferred to the buyer.

The seller's obligations under FCA

Export packaging and documentation

The seller is responsible for ensuring the goods are packaged appropriately for the export journey. Proper packaging is vital to protect the cargo from damage during transit. The seller must also prepare and provide several critical export documents. These documents typically include items such as the commercial invoice, packing list, and any required export licenses or other official authorizations needed to ship the goods out of the country.

Loading and pre-carriage

The seller's loading responsibilities depend entirely on the specified "named place."

- If the named place is the seller's premises, the seller is responsible for loading the goods onto the buyer's collecting vehicle.

- If the named place is another location (like a port terminal or forwarder's warehouse), the seller is responsible for the "pre-carriage" - transporting the goods to this location. Upon arrival, their obligation is complete before the goods are unloaded from their vehicle.

Export customs clearance

A primary responsibility of the seller under FCA is to handle and pay for all export customs formalities. This involves managing all the necessary paperwork, paying any export duties and taxes, and complying with any security-related requirements for export. By placing this duty on the seller, who is based in the country of export, the FCA rule simplifies the process for the buyer, who may not be familiar with local regulations.

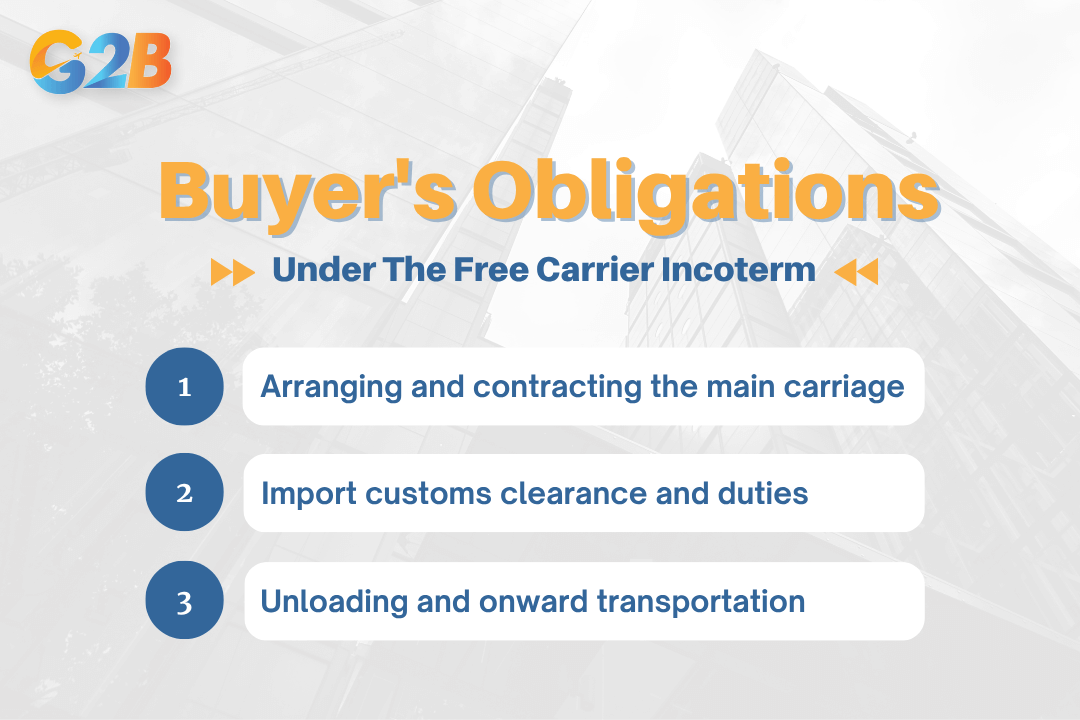

The buyer's obligations under FCA

Once the seller has fulfilled their obligations by delivering the goods to the nominated carrier at the named place, the responsibility for the shipment squarely shifts to the buyer. The buyer's control over the main part of the transport journey begins at this critical handover point.

The buyer's obligations under FCA

Arranging and contracting the main carriage

The buyer's principal duty is to contract and pay for the main carriage of the goods from the named place of delivery to the final destination. This means the buyer has complete control over selecting the carrier or freight forwarder, negotiating freight rates, and choosing the shipping route. This control allows buyers to leverage their own shipping relationships and potentially secure more favorable transport costs than if the seller arranged it.

Import customs clearance and duties

Upon the goods' arrival in the destination country, the buyer is responsible for all import customs clearance procedures. This includes preparing and submitting all required import documentation, paying any import duties and taxes, and handling any inspections mandated by customs authorities. This is a significant responsibility and requires a clear understanding of the import regulations in the destination country.

Unloading and onward transportation

The buyer assumes all costs and risks from the point the goods are delivered by the seller. This includes any terminal handling charges at the port of origin, the cost of unloading the goods from the seller's vehicle (if the named place is not the seller's premises), and the entire cost of the main transport leg. The buyer is also responsible for unloading the goods from the main carrier upon arrival at the destination and arranging any subsequent onward transportation to their final facility.

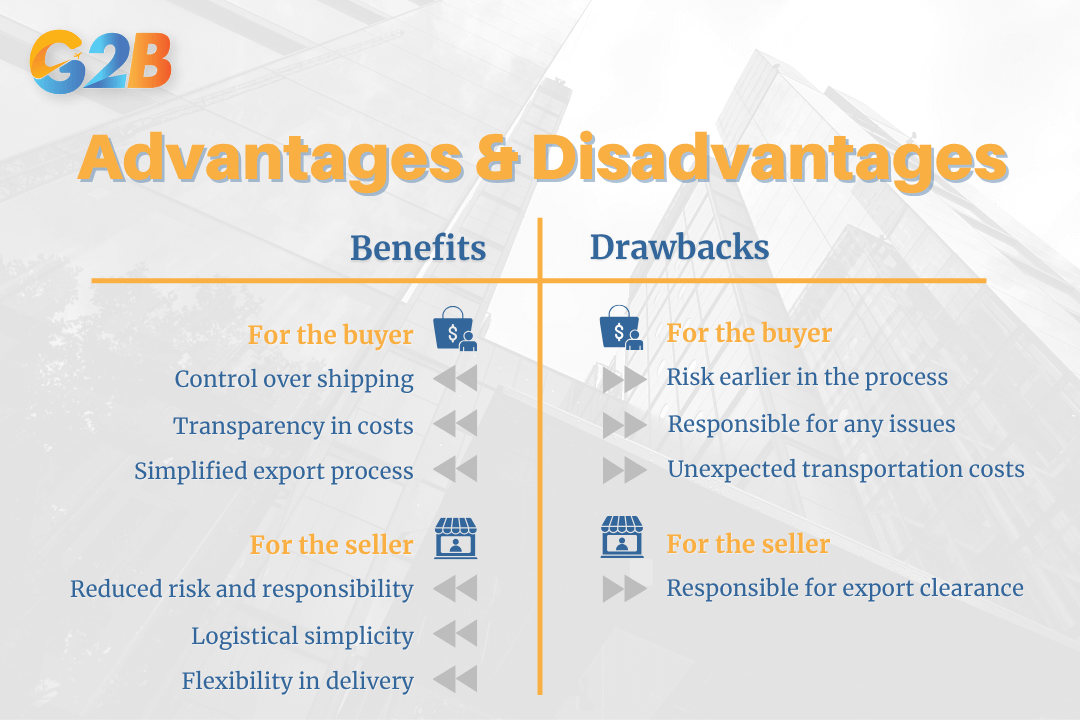

Advantages and disadvantages of using FCA

The Free Carrier rule offers a balanced distribution of responsibilities, presenting distinct benefits and potential drawbacks for both the seller and the buyer.

Advantages and disadvantages of using FCA

Benefits for the seller

- Reduced risk and responsibility: The seller's liability ends early in the shipping process, once the goods are handed over to the buyer's carrier. This significantly limits their exposure to risks during the main international transport leg.

- Logistical simplicity: The seller is not burdened with arranging and paying for the main carriage, which simplifies their logistical responsibilities and allows them to focus on their core operations.

- Flexibility in delivery: The seller can often choose a delivery location that is convenient for their operations, such as their own warehouse.

Benefits for the buyer

- Control over shipping: The buyer has full control over the main transportation, allowing them to select their preferred carriers and negotiate freight rates directly. This can lead to significant cost savings and better logistical management.

- Transparency in costs: Since the buyer arranges the main freight, they have direct visibility into transport costs, eliminating any potential markups from the seller.

- Simplified export process: The buyer is not required to handle export formalities in a foreign country, a task that the seller is typically better equipped to manage.

Potential drawbacks

- For the buyer: The buyer assumes risk earlier in the process compared to other Incoterms like DAP. They are also responsible for any issues that may arise at the origin terminal after the handover, such as terminal handling charges or delays. If the named place is not a port, the buyer may incur unexpected transportation costs to the actual port of export.

- For the seller: Although the seller's responsibilities are limited, they are still responsible for export clearance. Any errors or delays in this process can impact the entire shipment schedule.

How FCA compares to other incoterms

Understanding the key differences between FCA and other common Incoterms is vital for choosing the right rule for your specific transaction. The primary distinctions lie in the point of risk transfer and the allocation of responsibilities for loading, transport, and customs clearance.

FCA vs. EXW (Ex Works)

Under EXW, the seller's only obligation is to make the goods available at their own premises. The buyer is responsible for everything else, including loading the goods and clearing them for export. FCA is generally more advantageous for the buyer because it places the responsibility for export clearance and loading (at the seller's premises) on the seller. This is a crucial difference, as buyers may struggle with export regulations in the seller's country.

FCA vs. FOB (Free On Board)

The most critical distinction is that FOB is strictly for sea and inland waterway transport, while FCA is flexible and can be used for any mode of transport. Under FOB, the risk transfers from the seller to the buyer only when the goods are loaded on board the vessel at the port of origin. With FCA, the risk transfers earlier, at the named place, which could be an inland terminal long before the container reaches the port. For this reason, FCA is the recommended Incoterm for most containerized shipments.

FCA vs. DAP (Delivered at Place)

FCA and DAP represent opposite ends of the responsibility spectrum. With FCA, the seller's responsibility ends early, in the country of origin, and the buyer controls the main transport. Under DAP, the seller is responsible for arranging and paying for the main carriage and bears all risk until the goods arrive at the named destination place, ready for unloading. The buyer's responsibility under DAP only begins upon the shipment's arrival at the destination, where they handle import clearance and unloading.

Is FCA the right choice for your business?

Deciding whether Free Carrier is the appropriate Incoterm requires evaluating your logistical capabilities, risk tolerance, and the nature of your shipments.

Scenarios where FCA is recommended

- Containerized shipments: FCA is the preferred rule for modern containerized freight, as the handover to the carrier often occurs at an inland terminal, not "on board" a vessel as required by FOB.

- Buyers with logistical control: When a buyer has established relationships with freight forwarders or wants to consolidate shipments to control costs, FCA is an excellent choice.

- Multimodal transport: If the shipment involves multiple modes of transport (e.g., truck, rail, and sea), FCA's flexibility makes it a superior option to sea-only terms like FOB.

- When a buyer wants to avoid export formalities: For buyers who are not equipped to handle export customs in the seller's country, FCA provides a clear advantage over EXW.

Practical tips for using FCA

- Be precise about the "named place": The FCA Incoterm requires the buyer and seller to precisely define the "named place" in the sales contract to prevent disputes over cost and risk. Clearly state the full address of the terminal, warehouse, or factory. An ambiguous location can lead to confusion about who pays for terminal handling or unloading charges.

- Clarify loading responsibilities: The sales contract should explicitly state who is responsible for loading. Remember, if the named place is the seller’s premises, the seller must load. If it’s any other place, the buyer is responsible for unloading the seller's truck and loading the main carrier.

- Address transport documentation: Under the Incoterms® 2020 revision, a buyer can instruct their carrier to issue an on-board bill of lading to the seller, a feature added to assist with letter of credit transactions. This must be agreed upon in the sales contract.

- Secure cargo insurance: The buyer is responsible for the goods from the point of delivery. It is highly recommended that the buyer secures appropriate cargo insurance to cover the main leg of the journey.

Free Carrier (FCA) stands out as a versatile and balanced Incoterm that is well-suited for a wide range of international trade scenarios, particularly for modern containerized shipping. Its flexibility allows buyers to take control of their main transport logistics, which can lead to greater efficiency and cost savings, while clearly defining the seller's responsibilities up to a specific handover point. For foreign entrepreneurs looking to register a company in Vietnam, understanding FCA can be especially valuable when engaging in cross-border transactions. When both parties understand their respective obligations and define the terms with precision in the sales contract, FCA facilitates smoother, more predictable, and mutually beneficial global transactions.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom