Foreign direct investment (FDI) is a critical driver of global economic integration and a powerful tool for national development. As businesses look beyond domestic borders to expand their reach, access new markets, and enhance efficiencies, understanding the mechanics of FDI has never been more crucial. This article will provide essential information on every facet of FDI, from its fundamental definition and types to its real-world impact on businesses and economies.

What is foreign direct investment (FDI)?

Foreign Direct Investment (FDI) is an investment made by a company or individual from one country into business interests located in another country. Unlike more passive investments, the core characteristic of FDI is that it provides the investor with a significant degree of influence, typically the ability to participate in the management of the foreign business enterprise, rather than outright control in all cases. This is the primary distinction between FDI and Foreign Portfolio Investment (FPI), where an investor simply purchases equities or bonds of a foreign company without exercising active management.

The internationally recognized threshold for an investment to be considered an FDI is the acquisition of at least 10% of the voting power or ownership stake in a foreign enterprise. This level of ownership implies a "lasting interest" and a long-term strategic relationship between the investor and the foreign business. FDI can take the form of either establishing entirely new operations (greenfield investment) or acquiring existing foreign enterprises (mergers and acquisitions). The motivations behind FDI are diverse and strategic, primarily revolving around:

- Market access: Gaining entry into new markets to reach a broader customer base and circumvent trade barriers.

- Resource seeking: Acquiring access to raw materials, natural resources, or lower-cost labor not available in the home country.

- Efficiency gains: Optimizing production and supply chains by locating operations in countries with more favorable economic conditions, such as lower manufacturing costs or specialized skills.

Key characteristics of FDI

Two features fundamentally define FDI and separate it from other forms of international capital flows: Control and Lasting interest. These elements transform a simple financial transaction into a strategic, long-term commitment.

Two features fundamentally define FDI and separate it from other forms of international capital flows

- The element of control is the defining factor of FDI. It signifies the investor's intent to actively participate in and influence the management of the foreign enterprise. This active role goes far beyond the passive holding of securities typical of an FPI. Control is not merely about owning assets; it's about having a voice in strategic decisions, operational direction, and the future of the foreign business. This influence is typically established when an investor acquires a significant portion of voting stock, generally 10% or more, allowing them to shape company policy.

- Complementing control is the concept of lasting interest, which underscores the long-term nature of the investment. FDI is not a short-term speculation aimed at quick profits. Instead, it reflects a sustained relationship between the direct investor and the foreign enterprise, implying a commitment to growth and stability. This long-term perspective is crucial for the host country, as it often leads to sustained capital inflow, technology transfer, and job creation, distinguishing it from the more volatile nature of short-term portfolio investments.

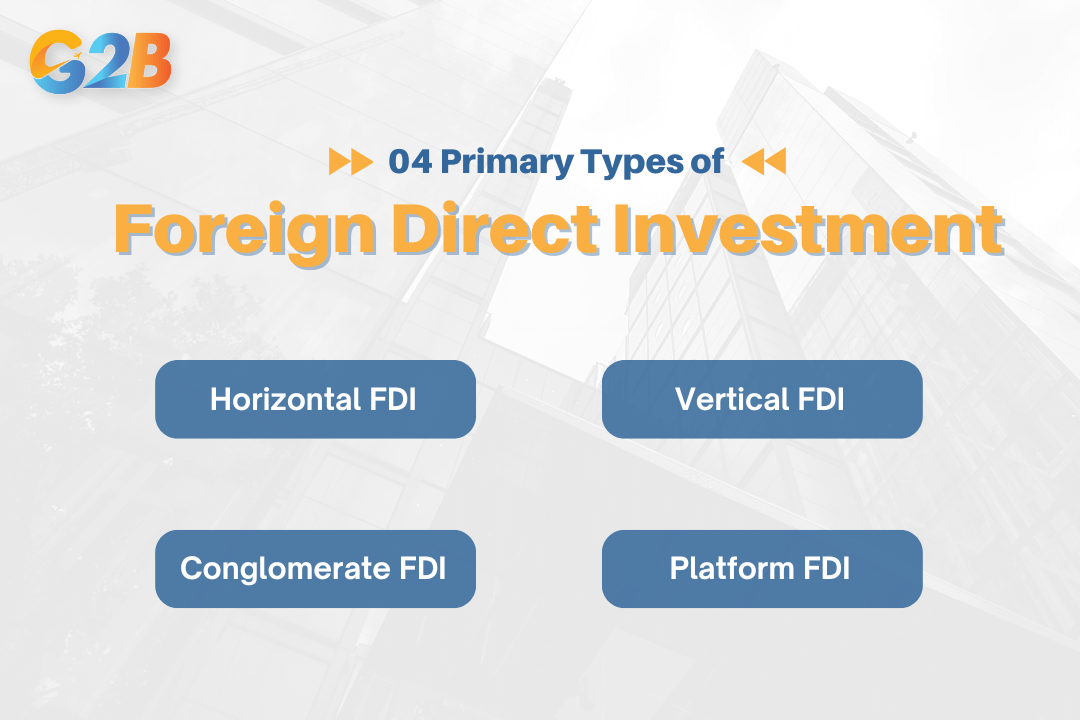

Types of foreign direct investment

Foreign direct investment is not a monolithic concept; it is categorized into distinct types based on the strategic objectives of the investing company and its relationship with the foreign enterprise. The four primary types of FDI are horizontal, vertical, conglomerate, and platform.

There are four primary types of FDI

Horizontal FDI

Horizontal FDI is the most common type of FDI, where a company invests in a foreign firm in the same industry. In this model, the multinational corporation (MNC) essentially duplicates its home country-based activities at the foreign location. The primary motivation is to expand its market presence, reach new customers, and overcome trade barriers.

- Example: A German automaker like Volkswagen opening a manufacturing plant in the United States to produce cars for the North American market is a classic example of horizontal FDI.

Vertical FDI

Vertical FDI occurs when an investment is made within the supply chain of a business, but not necessarily in the same industry. This strategy is aimed at gaining control over different stages of production. Vertical FDI can be broken down into two sub-categories:

- Backward vertical integration: This involves investing in a foreign firm that provides supplies or raw materials for the company's production process. For instance, a coffee company like Switzerland-based Nescafe might invest in coffee plantations in Brazil or Colombia.

- Forward vertical integration: This occurs when a company invests in foreign operations that are closer to the end consumer, such as distribution networks or marketing arms. A car manufacturer acquiring a dealership network in a foreign country is an example of forward vertical integration.

Conglomerate FDI

Conglomerate FDI is when a company invests in a foreign business that is completely unrelated to its core operations. This type of investment is less common because it requires navigating two significant challenges simultaneously: entering a foreign market and entering a new industry. The primary motivation is typically financial diversification to spread risk across different industries and markets.

- Example: If a U.S.-based technology company were to acquire a food processing business in France, it would be a conglomerate FDI.

Platform FDI

Platform FDI, also known as export-platform FDI, happens when a business expands into a foreign country to manufacture products that are then exported to a third country. This strategy often leverages favorable conditions in the host country, such as lower labor costs or preferential trade agreements with the final destination country.

- Example: An American company setting up a manufacturing plant in Vietnam to produce goods for export to markets across the European Union is engaging in platform FDI.

Methods of foreign direct investment

Once a company decides on its FDI strategy, it must choose the method of entry into the foreign market. The primary methods include establishing a new enterprise from the ground up or acquiring an existing one.

Greenfield investment

Greenfield investment is a form of FDI where a parent company starts a new venture in a foreign country by constructing new operational facilities from the ground up. This method involves building new factories, offices, and distribution centers. Greenfield investments are often preferred in developing countries because they create new jobs, introduce new technologies, and contribute to infrastructure development, which stimulates the local economy. For example, a company like McDonald's or Domino's establishing new outlets in India is a form of greenfield investment.

Brownfield investment (cross-border mergers & acquisitions)

Brownfield investment, more commonly referred to as cross-border mergers and acquisitions (M&A), involves purchasing or leasing existing facilities in a foreign country. This method is often a faster way to enter a market because the necessary infrastructure, operational processes, and employee base are already in place. M&A allows the investing company to quickly gain access to the target firm's existing market share, customer base, and brand recognition. This is the dominant form of FDI in developed nations.

Joint ventures and strategic alliances

A joint venture is a strategic alliance where two or more parties, typically from different countries, agree to pool their resources to accomplish a specific task. This often involves creating a new business entity where ownership, responsibilities, and profits are shared. Joint ventures are particularly effective for entering markets with high cultural or regulatory barriers, as they allow the foreign company to leverage the local partner's market knowledge, established networks, and government relationships.

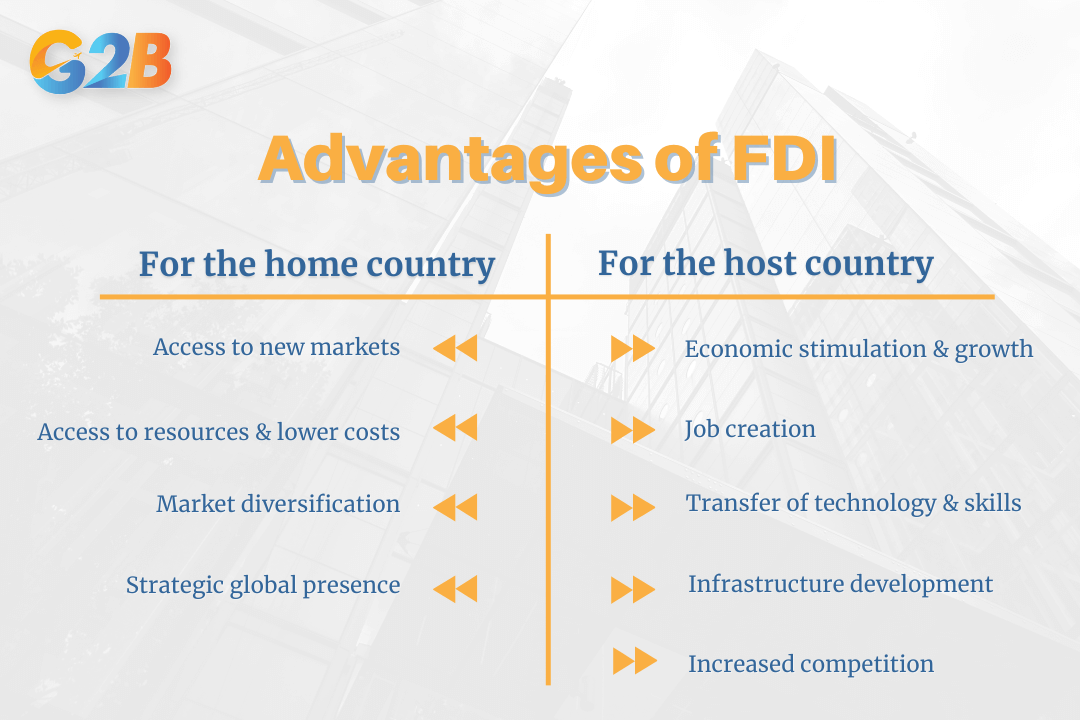

Advantages of foreign direct investment

FDI offers substantial benefits, creating a win-win scenario for both the host country receiving the capital and the home country of the investing company.

Foreign direct investment offers substantial benefits

Benefits for the host country

For the receiving nation, FDI is a powerful catalyst for economic development. The primary advantages include:

- Economic stimulation and growth: The inflow of capital from FDI boosts the host country's economy. This investment often goes into building new factories and services, leading to increased production and a higher GDP.

- Job creation: Establishing new business operations is one of the most significant advantages of FDI, as it directly creates new jobs, reduces unemployment, and increases the income and purchasing power of the local population.

- Transfer of technology and skills: Foreign companies often bring with them advanced technologies, management expertise, and operational practices. This knowledge transfer enhances the skills of the local workforce and can lead to a ripple effect, improving productivity across other sectors.

- Infrastructure development: FDI can lead to improvements in a country's infrastructure, such as roads, ports, and telecommunication networks, which benefits the entire economy.

- Increased competition and breaking monopolies: The entry of foreign firms into the domestic market fosters a more competitive environment, which can lead to lower prices and better quality goods and services for consumers.

Benefits for the home country (investing company)

The company's investment also reaps significant rewards:

- Access to new markets: FDI allows companies to bypass trade barriers and gain direct access to new and often larger markets, expanding their customer base and increasing sales.

- Access to resources and lower costs: Companies often invest abroad to access raw materials, cheaper labor, or other resources, which can significantly lower production costs and increase profitability.

- Market diversification: By operating in multiple countries, companies can diversify their business and reduce their dependence on a single domestic market, mitigating risks associated with economic downturns in their home country.

- Strategic global presence: FDI is a key component of building a multinational strategy, enhancing a company's brand recognition and solidifying its global presence.

Company formation in Vietnam for foreign investors

Vietnam has emerged as a prime destination for FDI, thanks to its rapid economic growth and strategic location. However, establishing a company in Vietnam requires navigating a specific legal framework. The process is governed by the Law on Investment and the Law on Enterprises, which have been progressively updated to create a more favorable environment for foreign investors.

Choosing a legal structure

Foreign investors have several options for business entities in Vietnam. The most common structures include:

- Limited Liability Company (LLC): This is the most popular choice for foreign investors due to its flexibility and simple structure. An LLC can be a single-member entity (owned by one individual or company) or a multi-member entity. In most business sectors, 100% foreign ownership is permitted.

- Joint-Stock Company (JSC): A JSC is the preferred structure for larger businesses or those planning to raise capital by issuing shares. It requires a minimum of three shareholders and is the only entity type that can be publicly listed on a stock exchange in Vietnam.

- Representative Office (RO): This option is suitable for market research, promotion, and supporting parent company activities. However, a Representative Office cannot generate revenue directly.

- Branch Office (BO): A Branch Office allows foreign companies to conduct commercial activities in Vietnam under the parent company's name. It can generate revenue, unlike a Representative Office, but requires the parent company to have been operational for at least five years.

The two-certificate registration process

Setting up a 100% foreign-owned company in Vietnam involves a two-step licensing process that typically takes two to four months.

- Step 1: The Investment Registration Certificate (IRC): This is the first and most critical step for any foreign investment project. The application is submitted to the Department of Planning and Investment (DPI) and requires detailed project information, proof of the investor's financial capacity (such as bank statements or recent financial statements), and a lease agreement for the company's registered address. This process usually takes about 20-30 working days depending on the complexity of the project and local authority workload.

- Step 2: The Enterprise Registration Certificate (ERC): Once the IRC is granted, the investor applies for the ERC, which officially establishes the company as a legal entity in Vietnam and provides its tax identification number. This step is much quicker, typically taking around three working days.

Key considerations and requirements

- Market access conditions: While Vietnam is open to foreign investment, some sectors are conditional or restricted. Investors must check Vietnam's commitments to the World Trade Organization (WTO) to understand any limitations on foreign ownership ratios or business activities.

- Capital requirements: For most business lines, there is no mandated minimum capital. However, the proposed capital must be deemed "sufficient" by the licensing authorities to cover the project's expenses. After the company is established, investors must open a Direct Investment Capital Account (DICA) to transfer the charter capital into Vietnam within 90 days of receiving the ERC.

- Post-licensing procedures: After receiving the ERC, the new company must complete several additional steps, including making a company seal, registering for tax, opening a bank account, registering labor, obtaining necessary business licenses for specific activities, and registering with the provincial Department of Labor.

Foreign direct investment stands as a cornerstone of the modern globalized economy. It fuels economic growth, creates jobs, facilitates the transfer of crucial technology and skills, and fosters a more interconnected and competitive international marketplace. For businesses aiming to expand their global footprint and for countries seeking to accelerate their development, a deep understanding of FDI is essential.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom