Foreign investment is the flow of capital from one country to another, giving foreign investors a significant ownership stake in domestic companies and assets. This movement of capital is a cornerstone of the modern global economy, enabling companies to expand their reach, access new markets, and tap into global talent pools. Let’s discover the definition of foreign investment, its main categories, the significant upsides, and the potential downsides in this article.

What is foreign investment?

The definition of foreign investment involves capital flows from one country to another, where an investor from a home country acquires an asset in a foreign (host) country. This process is a fundamental element of international economic integration, creating stable and lasting links between economies. Unlike historical colonialism, modern foreign investment is built on the principle of mutual benefit, where the transfer of capital aims for both profit for the investor and economic development for the host nation.

Foreign investment manifests in several ways, such as a corporation building a factory overseas, an investment fund buying shares on a foreign stock exchange, or an individual purchasing foreign government bonds. These international capital flows are essential for a connected global economy, allowing capital to seek the highest rate of return and fostering the spread of best practices in corporate governance and technology.

How foreign investment work?

Foreign investment works through two primary mechanisms that are distinguished by the investor's level of control and long-term commitment. The main classifications are active investments, known as Foreign Direct Investment (FDI), and passive investments, categorized as Foreign Portfolio Investment (FPI). The crucial difference lies in the investor's intent and degree of control over the foreign enterprise.

Foreign investment works through two primary mechanisms

Foreign Direct Investment (FDI)

Foreign Direct Investment (FDI) is a substantial, long-term investment made by a company, government, or individual from one country into a business or asset in another country with the intent of establishing a "lasting interest." This is not merely a financial transaction; it represents a significant commitment to the host country. The universally accepted benchmark for establishing FDI is the acquisition of at least 10% of the voting stock in a foreign-based company (this threshold may vary by country or international guidelines).

This threshold signifies that the investor intends to have a degree of "significant influence" over the enterprise's management, operations, and strategic decisions. FDI can take many forms, including building new facilities from the ground up (greenfield investment), acquiring or merging with an existing foreign company, or establishing a joint venture with a local partner.

Horizontal FDI

Horizontal FDI is the most common type of foreign direct investment. It occurs when a company duplicates its home country-based activities at the same stage of the value chain in a host country. In essence, the firm invests in a foreign company within the same industry, producing similar goods or services. A German automaker opening a manufacturing plant in the United States to produce the same models of cars is a classic example of Horizontal FDI. This strategy is often employed to gain access to new markets, overcome trade barriers, and reduce transportation costs by producing closer to the consumer.

Vertical FDI

Vertical FDI takes place when a company invests in a foreign business that is at a different stage of its supply chain. This investment can be either backward or forward along the production process. Backward vertical FDI happens when a firm invests in a foreign supplier of its inputs or raw materials. For instance, a Swiss coffee company investing in coffee plantations in Vietnam to secure its supply of coffee beans is a form of backward vertical integration. Conversely, forward vertical FDI involves investing in foreign-based distribution or marketing capabilities, such as a U.S. manufacturer acquiring a foreign company that handles its product distribution abroad.

Conglomerate FDI

Conglomerate FDI is when a company invests in a foreign business that is completely unrelated to its core operations in its home country. This type of investment is driven by a strategy of diversification, aiming to spread risk across different industries and markets. An example would be a technology company from South Korea investing in a food processing business in the United States. While it can be challenging due to the lack of industry-specific expertise, Conglomerate FDI allows a multinational corporation to enter new, potentially high-growth sectors and mitigate the risks associated with its primary industry.

Platform FDI

Platform FDI is a strategic investment where a company establishes operations in one foreign country with the primary purpose of exporting its products or services to a third country. The host country serves as an export platform, often due to favorable trade agreements, lower production costs, or strategic geographic location. For example, a Japanese corporation might build a manufacturing plant in Vietnam to produce goods that will then be exported to other countries in the ASEAN region. Platform FDI leverages the unique advantages of the host country to serve a broader regional or global market.

Foreign Portfolio Investment (FPI)

Foreign Portfolio Investment (FPI) refers to the purchase of financial assets in a foreign country, such as stocks, bonds, and mutual funds, without the intent of gaining direct managerial control. It is considered a passive, and often short-term, investment. The primary motivation for FPI is to diversify a portfolio and capitalize on favorable market conditions, such as high interest rates or anticipated currency appreciation in the host country. An investor purchasing shares of a Vietnamese company on the Ho Chi Minh City Stock Exchange is a clear example of FPI. Unlike FDI, FPI does not give the investor managerial control over the foreign company. This makes it more liquid and volatile, as these assets can be sold off quickly in response to market changes, which can heighten economic instability in the host country.

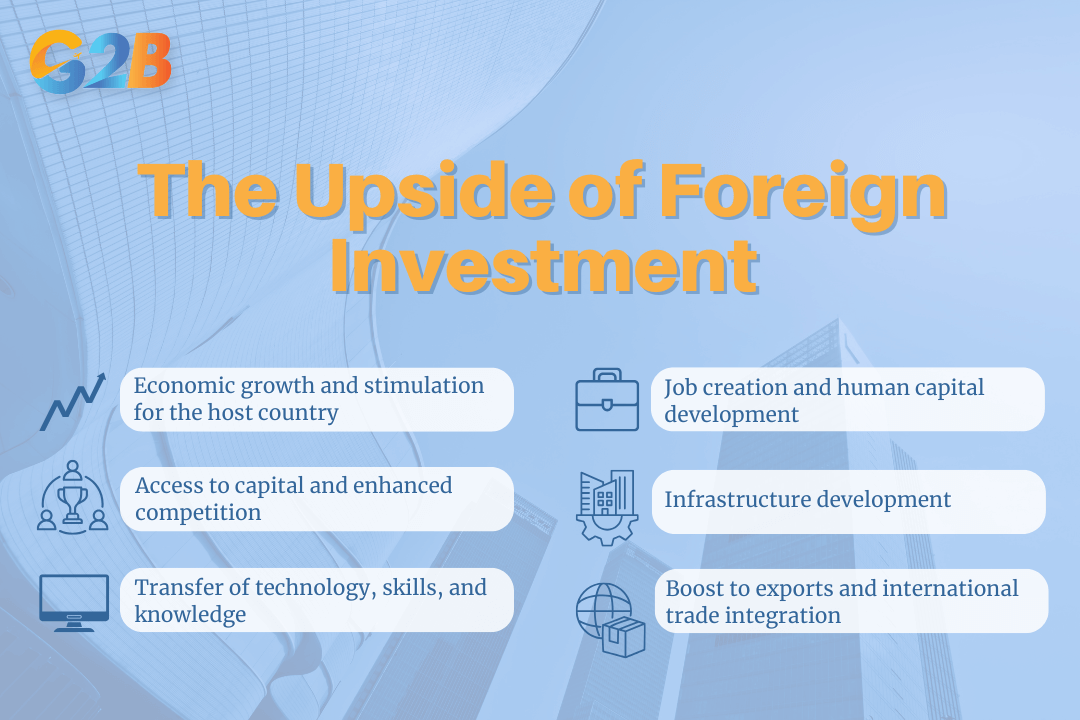

The upside of foreign investment

Foreign investment, particularly FDI, is widely recognized as a major catalyst for development, offering a multitude of benefits that can transform a host country's economic landscape. From stimulating growth to building human capital, the infusion of foreign capital and expertise creates a ripple effect across the entire economy.

Foreign investment offers a multitude of benefits

Economic growth and stimulation for the host country

One of the most significant benefits of foreign investment is its direct contribution to economic growth. By injecting capital into the economy, FDI finances new projects, expands existing businesses, and increases overall production, all of which contribute to a higher Gross Domestic Product (GDP). This influx of capital supplements domestic savings and investment, allowing countries to fund development projects and build productive capacity that would otherwise be out of reach.

Access to capital and enhanced competition

Foreign investment provides domestic firms with access to a larger pool of capital, which is especially crucial in developing countries where financial markets may be less developed. The availability of funds allows local industries to expand and modernize. Furthermore, the entry of multinational corporations increases competition in the domestic market. This heightened competition often forces local firms to become more efficient, innovative, and consumer-focused, leading to better quality products and services for the public.

Transfer of technology, skills, and knowledge

Foreign investors often bring with them advanced technologies, innovative production techniques, and modern managerial skills. This process, known as technology transfer, is the sharing or exchange of knowledge, skills, and technology from an international investor to a host country for the purpose of economic development. Local employees gain valuable training and experience, and domestic firms can learn and adopt these superior practices through observation, imitation, and supply-chain linkages, leading to a significant increase in the host country's overall productivity and competitiveness.

Job creation and human capital development

Foreign direct investment is a major source of employment. When a multinational corporation builds a new factory or establishes a subsidiary, it directly creates jobs for local workers. Beyond direct employment, FDI also generates indirect jobs through its demand for goods and services from local suppliers. Moreover, foreign companies often invest in training their local workforce, contributing to the development of human capital by upgrading skills and enhancing the knowledge base of the host country's labor force.

Infrastructure development

Large-scale FDI projects frequently necessitate and contribute to the development of local infrastructure. Foreign investors may build or improve roads, ports, and telecommunication networks to support their operations. These infrastructure improvements benefit not only the foreign firm but also the entire host economy, creating a better environment for all businesses and improving the quality of life for citizens.

Boost to exports and international trade integration

Many foreign investments, particularly in the manufacturing sector, are export-oriented. Multinational corporations often use the host country as a production base to serve regional or global markets, thereby increasing the host country's exports. This integration into global value chains helps the host country earn foreign exchange, improve its balance of payments, and gain access to international markets that might have been difficult for domestic firms to penetrate on their own.

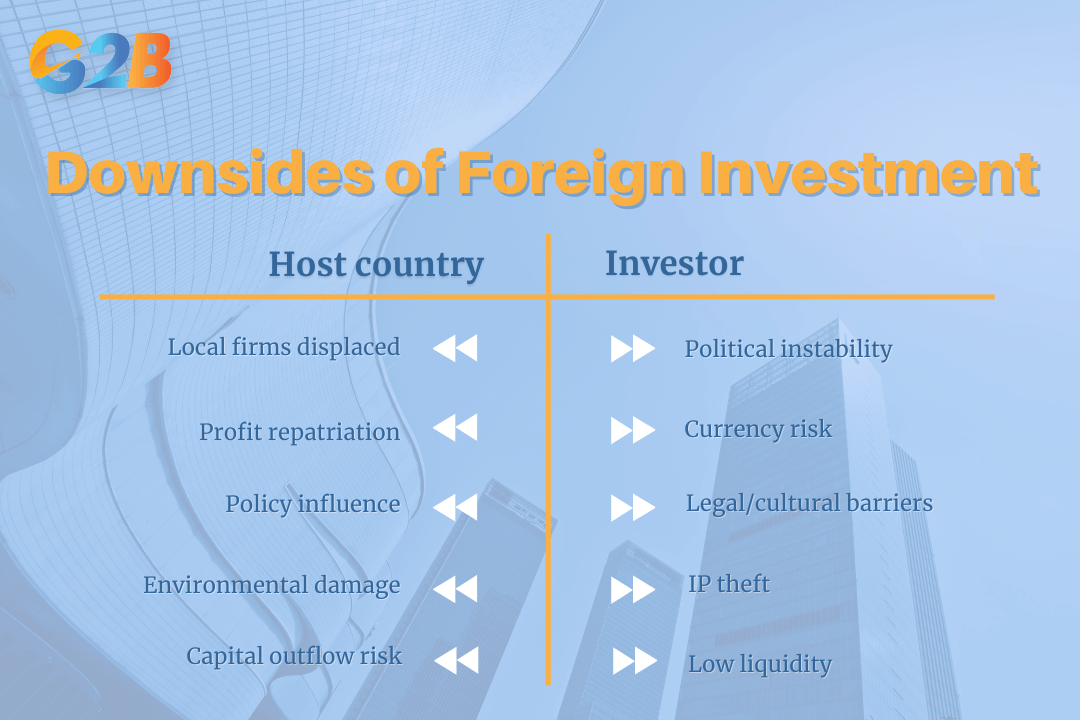

The downside of foreign investment

While the benefits of foreign investment are substantial, it is not without potential risks and negative consequences. A balanced perspective requires acknowledging that these capital inflows, if not properly managed and regulated, can create challenges for both the host country and the investors themselves.

Foreign investment can create challenges for both the host country and the investors

For the host country

The arrival of large, efficient multinational corporations can sometimes overwhelm and displace smaller, less competitive local businesses, leading to a loss of domestic entrepreneurship. There is also a risk that foreign firms may repatriate profits back to their home country, limiting the amount of capital that is reinvested locally. Furthermore, powerful foreign companies could potentially exert undue influence on the host country's government policies to gain favorable treatment. In some cases, large-scale industrial projects may also lead to environmental degradation if not held to high standards. Finally, an over-reliance on foreign capital, especially volatile FPI, can make a host country's economy vulnerable to sudden capital outflows during times of global financial uncertainty.

For the investor

Investors also face a unique set of risks when venturing abroad. Political instability in the host country is a primary concern, as unexpected changes in government or policy can jeopardize an investment. Currency fluctuations can also negatively impact the value of assets and the profitability of repatriated earnings. Other risks include potential cultural clashes, navigating complex and unfamiliar legal and regulatory systems, and the possibility of intellectual property theft. For companies making direct investments, the lack of liquidity is also a factor; FDI involves a long-term commitment to physical assets that cannot be sold off quickly in a downturn.

Potential of Vietnam for foreign investment

Vietnam has firmly established itself as a prime destination for foreign investment in Southeast Asia, driven by a combination of political stability, strong economic growth, and a government committed to creating a favorable business environment. Recent policy reforms and new laws on investment are designed to reduce barriers, enhance transparency, and attract high-quality FDI, particularly in high-tech industries. In the first five months of 2025 alone, foreign investment in Vietnam surged to nearly $18.4 billion, which refers to registered capital and may differ from actual disbursed capital, a 51% increase year-on-year.

Vietnam’s strategic location, competitive labor costs, and growing network of free trade agreements make it an ideal export hub for multinational corporations. These advantages have also fueled strong demand for company formation in Vietnam, as investors seek to capitalize on the country’s expanding industrial and technological base. The government is actively encouraging investment in priority sectors such as renewable energy, semiconductors, artificial intelligence (AI), and advanced manufacturing. With a young, educated, and increasingly urbanized population, Vietnam offers a dynamic domestic market alongside its export potential. The continued development of infrastructure and streamlined administrative procedures further enhance its appeal.

Foreign investment is a multifaceted and powerful force in the global economy. It is broadly categorized into Foreign Direct Investment (FDI), which signifies a long-term, controlling stake in a foreign enterprise, and Foreign Portfolio Investment (FPI), a more passive and liquid investment in financial assets. The benefits for a host country are immense, ranging from direct economic stimulation and job creation to the invaluable transfer of technology and skills that drives long-term productivity. However, these advantages must be weighed against potential risks, such as the displacement of local firms and the economic volatility that can accompany sudden capital flows.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom