Flow-Through Entities are a cornerstone of modern business structure, offering a stark contrast to traditional corporate taxation by allowing profits and losses to be passed directly to the owners' personal tax returns. For entrepreneurs, small business owners, and foreign expatriates looking to operate in dynamic markets like Vietnam, understanding this concept is not just beneficial - it's fundamental to strategic financial planning and legal compliance. This guide dissects the core definition of these structures, explores the distinct types available, and provides a roadmap for foreign investors registering a company in Vietnam.

What are flow-through entities?

A flow-through entity, also known as a pass-through entity, is a type of business entity where the income of the company is not taxed at the corporate level. Instead, the profits, losses, deductions, and credits are "passed through" directly to the owners, who then report this information on their personal income tax returns. This model avoids the double taxation scenario often associated with traditional C corporations, where profits are first taxed at the corporate rate and then again when distributed to shareholders as dividends.

The business itself generally does not pay income tax; it acts as a conduit for the income to flow to its owners. Consequently, the owners are taxed at their individual income tax rates on their share of the entity's profits, regardless of whether the profits are actually distributed to them in cash. This structure is common for businesses like sole proprietorships, partnerships, S corporations, and limited liability companies (LLCs).

Types of flow-through entities

Flow-through taxation applies to several common business structures, each with its own unique characteristics.

Sole Proprietorship

"Sole Proprietorship" is an unincorporated business owned and run by one individual, making it the simplest of all business structures. There is no legal distinction between the owner and the business; the owner is personally responsible for all the business's debts and liabilities. All profits and losses are reported on the owner's personal tax return, typically through a Schedule C form attached to their Form 1040.

Partnership

"Partnership" is a legal business structure where two or more individuals co-own a business and agree to share in the profits and losses. Like sole proprietorships, partnerships pass their profits and losses directly to the partners, who report them on their personal tax returns. The partnership itself files an informational return (Form 1065) with the IRS.

General Partnerships

"General Partnerships" are a type of partnership where all partners typically share in management and have unlimited liability, meaning they are personally responsible for the business's debts.

Limited Partnerships (LPs)

"Limited Partnerships (LPs)" involve at least one general partner who manages the business and has unlimited liability, alongside one or more limited partners who contribute capital but have limited liability and are not involved in daily management. A limited partner's liability is restricted to the amount of their investment in the company.

Limited Liability Partnerships (LLPs)

"Limited Liability Partnerships (LLPs)" provide liability protection for all partners, shielding them from the debts of the business and the actions of other partners. This structure is particularly common for professional firms, such as those for lawyers, accountants, and architects.

S Corporation

"S Corporation" is a special type of corporation that elects to be taxed as a pass-through entity under Subchapter S of the Internal Revenue Code. This structure allows profits and losses to be passed directly to the owners' personal income without being subject to corporate tax rates. S corporations must meet certain requirements, including having no more than 100 shareholders and only one class of stock.

Limited Liability Company (LLC)

"Limited Liability Company (LLC)" is a hybrid business structure that combines the liability protection of a corporation with the tax benefits of a pass-through entity. By default, a single-member LLC is taxed like a sole proprietorship, and a multi-member LLC is taxed like a partnership, though it can elect to be taxed as an S corporation or a C corporation instead of the default flow-through taxation.

Advantages and disadvantages of flow-through entities

Choosing a pass-through structure offers significant benefits but also comes with specific drawbacks that every business owner must consider.

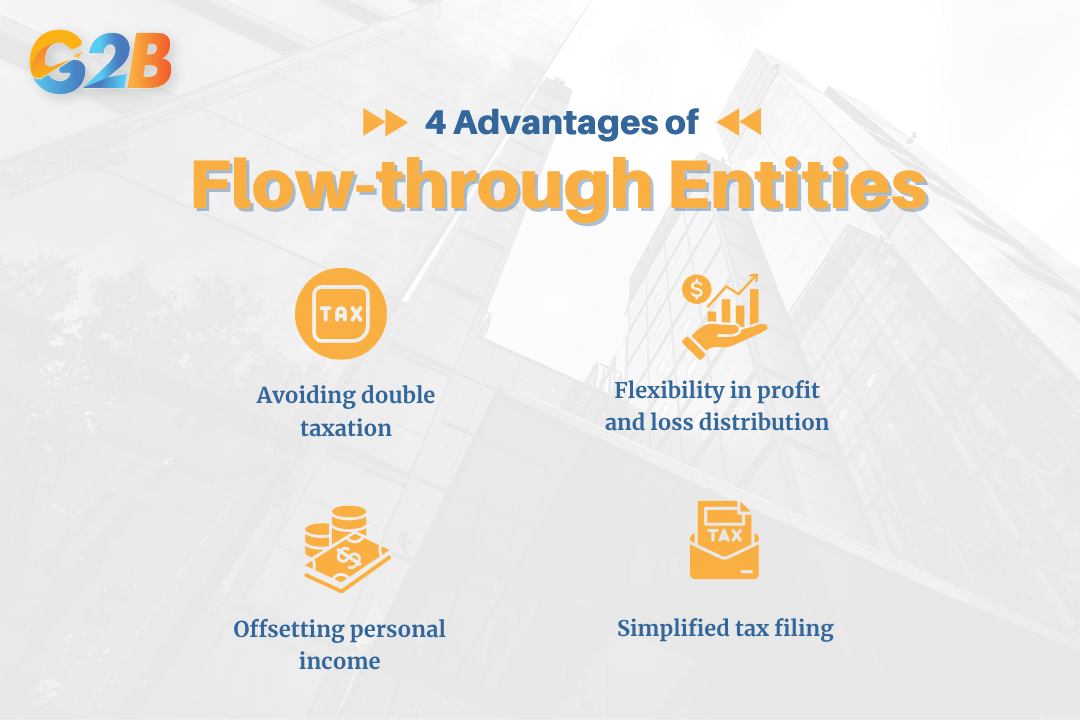

Advantages of flow-through entities

- Avoiding double taxation: The primary advantage of a flow-through entity is the avoidance of double taxation. In a C corporation, profits are taxed first at the corporate level and then again at the individual level when distributed as dividends. Flow-through entities eliminate the corporate-level tax, meaning income is taxed only once on the owners' personal returns. This can result in significant tax savings.

- Flexibility in profit and loss distribution: Certain flow-through structures, such as LLCs and partnerships, offer great flexibility in how they allocate profits and losses among owners. Unlike corporations, where distributions are typically tied to the percentage of ownership, partners in an LLC can create a detailed operating agreement that distributes profits and losses in different proportions, a concept known as special allocations.

- Offsetting personal income: Business losses generated by a pass-through entity can be used to offset other personal income on the owner's tax return. For example, if an owner has a day job and their new business operates at a loss in its first year, that loss can pass through and potentially lower their total taxable income from all sources, reducing their overall tax bill.

- Simplified tax filing (in some cases): For the simplest structures, tax filing is often more straightforward. A sole proprietor, for instance, reports business income and expenses on a Schedule C, which is filed with their personal Form 1040. This integration simplifies the administrative burden compared to filing a separate, complex corporate tax return.

4 Advantages of flow-through entities

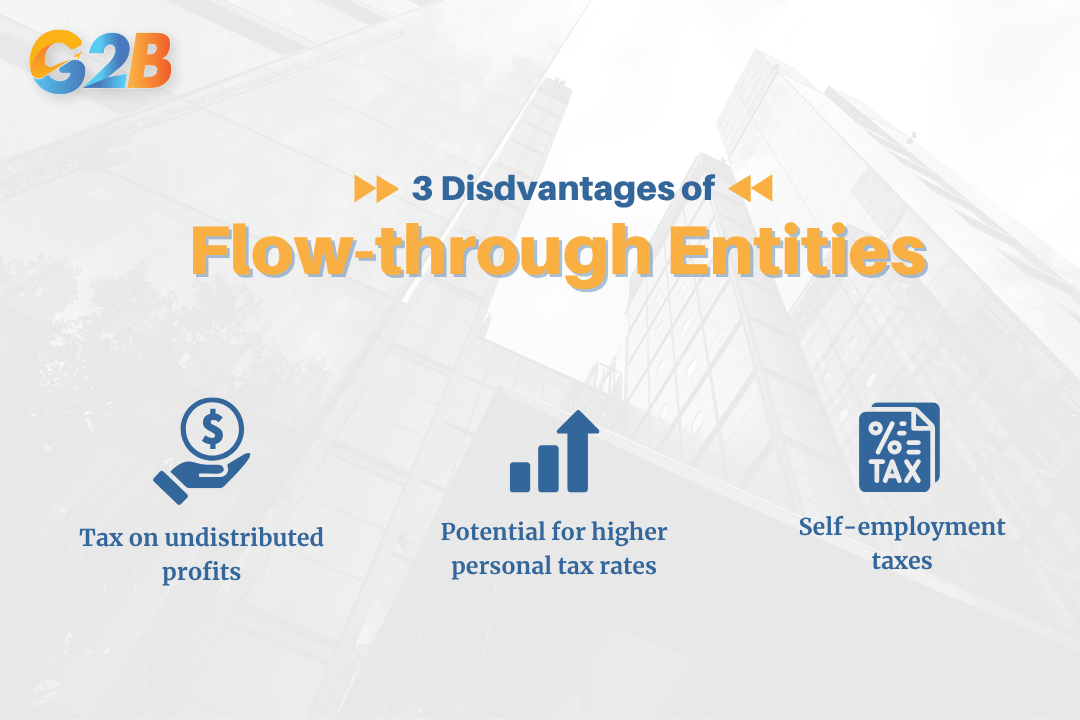

Disadvantages of flow-through entities

- Tax on undistributed profits: A significant drawback is that owners are taxed on their share of the business's profits, regardless of whether they actually receive that money as a cash distribution. If a business needs to retain earnings to reinvest in growth, purchase inventory, or save for future expenses, the owners must still pay personal income tax on those profits, potentially creating a cash flow problem for the owner.

- Potential for higher personal tax rates: If the business is highly profitable, the pass-through income can push the owners into the highest individual income tax brackets, which may be higher than the flat corporate tax rate. This means that for very successful businesses, a C corporation structure could sometimes result in a lower overall tax burden, especially if profits are consistently reinvested rather than distributed.

- Self-employment taxes: Owners of many flow-through entities who are actively involved in the business are considered self-employed and must pay self-employment taxes. This tax covers both the employer and employee portions of Social Security and Medicare taxes, which can be a substantial additional tax liability on their earnings. While S corporation owners can take a portion of their income as a salary and the rest as distributions to potentially reduce this tax, it adds a layer of complexity.

3 Disadvantages of flow-through entities

How to register a business in Vietnam for expats

While understanding flow-through entities is crucial for tax planning in many countries, foreign investors in Vietnam typically must form a distinct legal entity like a Limited Liability Company (LLC) or a Joint-Stock Company (JSC). Navigating the registration process in Vietnam can be complex due to its unique regulatory landscape, but it follows a clear path. Here is a step-by-step guide to registering your business in Vietnam.

Step 1: Define your business scope

Before any paperwork is filed, you must clearly define your intended business activities. Vietnam uses a system of industry codes, and you must specify the exact codes that correspond to your business lines. Some sectors are restricted or prohibited for foreign investors under Vietnam's Investment Law and WTO commitments, so it's critical to verify that your chosen activities are permissible.

Step 2: Choose a legal structure

The most common and recommended structure for foreign investors in Vietnam is the Limited Liability Company (LLC). An LLC in Vietnam can be 100% foreign-owned in most sectors and provides liability protection for its owners. It can be set up as a single-member LLC (one owner) or a multi-member LLC (two or more owners).

Step 3: Secure a business address

You must have a physical business address in Vietnam before you can register your company. This address must be a legitimate, verifiable location, and you will need to provide a signed lease agreement or relevant documents as proof of your right to use the address.

Step 4: Prepare key documents

A crucial part of the process is preparing the necessary legal documents. For foreign investors, this typically includes:

- Notarized copies of the investors' passports (for individuals) or Certificate of Incorporation (for corporate investors).

- Bank statements or audited financial reports to demonstrate the investor's financial capacity.

- The company charter (also known as articles of association). All foreign documents must be notarized, consular legalized, and translated into Vietnamese by a certified translator.

Step 5: Apply for the investment registration certificate (IRC)

For any foreign-owned project, the first major approval needed is the Investment Registration Certificate (IRC). This application is submitted to the Department of Planning and Investment (DPI). The IRC application details the investor, the project's objectives, its scale, the location, and the amount of investment capital. This certificate officially licenses your investment project in Vietnam.

Step 6: Apply for the enterprise registration certificate (ERC)

Once the IRC is granted, the next step is to obtain the Enterprise Registration Certificate (ERC). This certificate officially establishes your company as a legal entity in Vietnam and contains key information like the company's name, address, tax number, and legal representative. The issuance of the ERC marks the official birth of your company.

Step 7: Make a company seal

After receiving the ERC, your company must create an official company seal (or stamp). While regulations have become more flexible, the seal remains a formal requirement for executing official company documents in Vietnam. The seal's sample must be publicly disclosed on the National Business Registration Portal.

Step 8: Open corporate bank accounts

With the ERC, you can now open the necessary corporate bank accounts. You will need at least two types:

- A direct investment capital account (DICA): This special account is used to transfer your investment capital (charter capital) into Vietnam. All capital contributions must flow through this account.

- A current account: This is a standard transaction account used for daily business operations in Vietnam.

Step 9: Contribute charter capital

The charter capital is the amount of money the owners commit to investing in the company, as stated in the ERC. You must contribute this capital in full within 90 days (or the timeline specified by the company's charter) of receiving the Enterprise Registration Certificate. The contribution must be made via bank transfer through the DICA. Failure to meet this deadline can result in penalties.

Step 10: Fulfill initial tax and labor obligations

Once the company is officially established, you must complete several post-registration steps immediately. These include:

- Tax registration: Registering with the local tax authority to pay business license tax and declare other taxes like VAT and Corporate Income Tax.

- Digital signature: Purchasing a digital signature for electronic tax filing.

- Labor registration: If you plan to hire employees, you must register with the local labor department and set up social insurance contributions.

There are 10 steps to register your business in Vietnam

Understanding the nuances of flow-through entities is critical for optimizing tax strategy and choosing the right business structure. From the simplicity of a sole proprietorship to the flexible protection of an LLC, these entities offer powerful advantages, primarily the avoidance of double taxation. However, as demonstrated by the detailed process for establishing a company in Vietnam, translating business concepts into a compliant, operational reality in a foreign market requires deep expertise and precise execution.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom