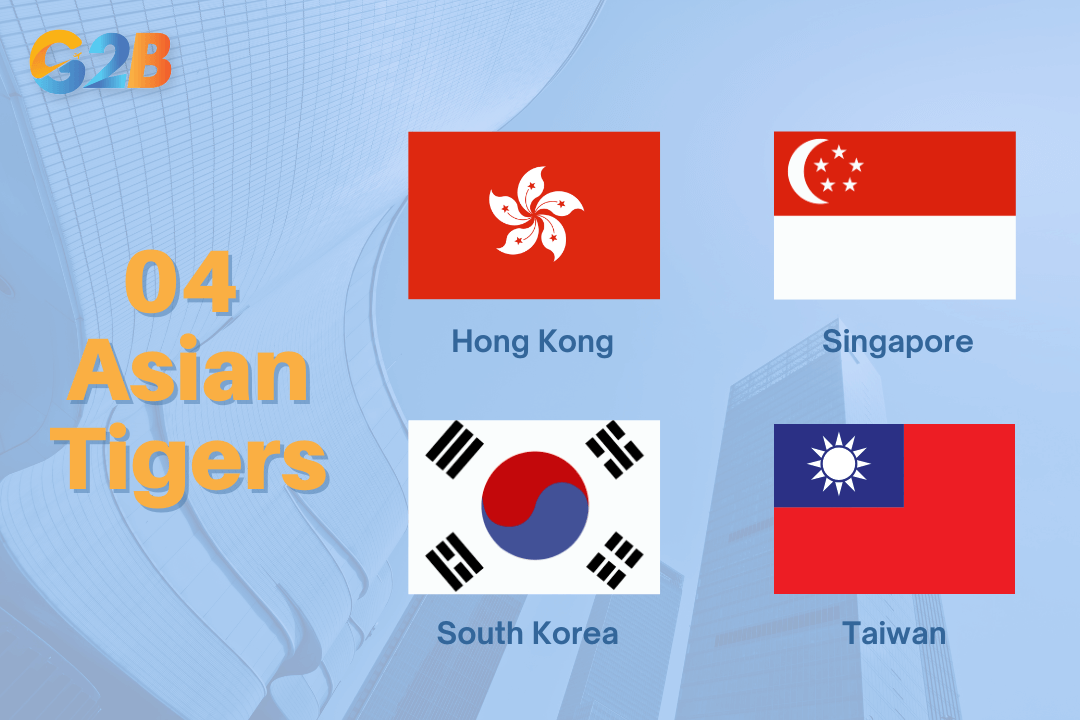

Four Asian Tigers refers to the economies of South Korea, Taiwan, Hong Kong, and Singapore, which underwent astonishingly rapid industrialization and economic growth between the 1960s and 1990s. This meteoric rise, often dubbed the "East Asian Miracle," transformed these nations from developing territories into high-income global powerhouses in just a few decades. Let’s explore the blueprint for their success, the unique journey of each nation, and the lessons their economic miracle holds for businesses today.

This article provides readers with a clearer understanding of the Four Asian Tigers. We specialize in company formation and do not offer financial or investment advisory services. For detailed investment guidance, please consult a qualified financial expert.

Who are the four Asian tigers?

The Four Asian Tigers, also known as the Four Asian Dragons, are the high-growth economies of Hong Kong, Singapore, South Korea, and Taiwan. The "Tiger" moniker was adopted to reflect their aggressive and rapid economic growth, which saw them consistently maintain exceptionally high growth rates of over 7 percent a year primarily during the 1960s to 1990s. This sustained expansion propelled them into the ranks of the world's wealthiest nations, with significantly high GDP per capita levels comparable to developed countries.

These economies are classified as Newly Industrialized Economies (NIEs), and their remarkable development has become a model for many other developing nations, especially the "Tiger Cub Economies" of Southeast Asia, which include Indonesia, Malaysia, the Philippines, Thailand, and Vietnam. The Tigers' journey demonstrated that with strategic planning and a focus on specific economic drivers, rapid advancement on the global economic stage is possible.

These economies shared several common characteristics that laid the foundation for their success. These characteristics include a strong focus on exports, a highly educated and skilled workforce, and high rates of saving and investment. By the 21st century, each had carved out specialized areas of competitive advantage: Hong Kong and Singapore emerged as leading international financial centers, while South Korea and Taiwan became global leaders in high-tech manufacturing and innovation.

The Four Asian Tigers are powerful economies known for their rapid industrial growth

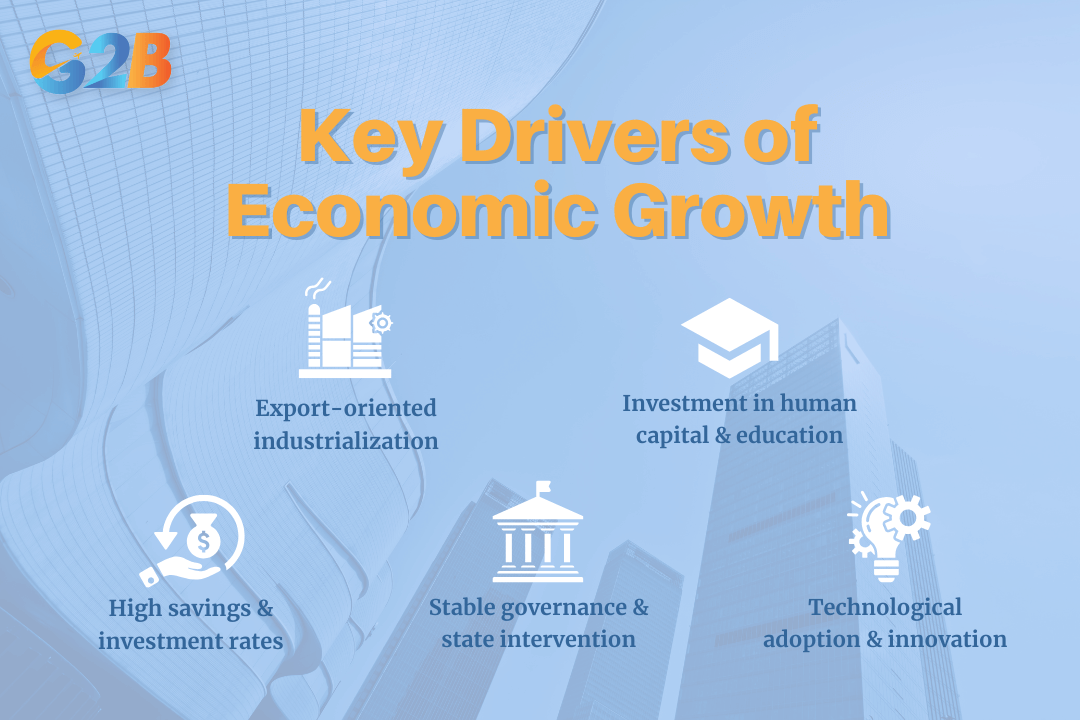

Key drivers of economic growth

The incredible success of the Four Asian Tigers was not accidental; it was the result of a deliberate and powerful mix of development policies and strategic government intervention. While each took a unique path, their economic models shared a common blueprint for rapid growth.

There are 5 key drivers that powered the Four Asian Tigers’ growth

A World Bank report on the "East Asian Miracle" identified two primary pillars for their success: Factor accumulation and macroeconomic management. This meant investing heavily in their people and industries while maintaining a stable economic environment. Here are the key drivers that powered their growth:

- Export-oriented industrialization (EOI): This was the cornerstone of their success. Instead of focusing on producing goods for small domestic markets (import substitution), the Tigers concentrated on manufacturing for global export. This outward-looking strategy forced their industries to become competitive on a global scale, driving innovation, efficiency, and quality. The United States, aiming to counter Soviet influence during the Cold War, supported this shift by opening its markets to Taiwanese and Korean goods and providing significant foreign aid to several East Asian countries to promote export-led growth.

- Investment in human capital and education: Recognizing that a skilled workforce is essential for industrialization, all four governments invested heavily in education. This focus on human capital created a highly literate and productive population capable of adapting to new technologies and manufacturing processes. In addition to universal primary and secondary education, technical and vocational training programs were expanded to meet the needs of industries. This strategic investment resulted in one of the most highly skilled workforces in the world, which was critical for their transition into high-tech and knowledge-based industries.

- Stable governance and state intervention (the developmental state): The Tigers' governments played a crucial and active role in steering economic development. This model, often referred to as the "developmental state," involved creating stable macroeconomic environments. They managed budget deficits and generally maintained relatively low external debt levels, with South Korea controlling its debt prudently before the 1997 Asian Financial Crisis, and maintained stable exchange rates to support their export industries. These governments often identified key industries for growth, provided subsidies and protection to help them scale, and facilitated the transfer of technology from more developed nations.

- High savings and investment rates: The populations within the Tiger economies exhibited high rates of saving. This cultural and economic trait created a large pool of domestic capital that was then channeled into strategic investments in infrastructure, technology, and industrial development, reducing reliance on foreign debt for initial growth.

- Technological adoption and innovation: The Tigers were not just assemblers of foreign goods; they were rapid adopters and, eventually, innovators of technology. They began by importing and adapting foreign technologies and then built upon that foundation to become leaders in their own right, particularly in electronics and information technology.

| Growth Strategy | South Korea | Taiwan | Hong Kong | Singapore |

|---|---|---|---|---|

| Primary Focus | Heavy industry, Chaebol-led | Small & Medium Enterprises, Tech | Laissez-faire, Finance, Trade | FDI-driven, Logistics, Finance |

| State Role | Highly interventionist, "Developmental State" | Active guidance, tech promotion | Minimal intervention, "Positive non-interventionism" | Highly strategic, state-owned enterprises |

| Key Policy | Export promotion, Chaebol support | Land reform, SME financing | Free port, low taxes | Attracting foreign direct investment |

While this model produced decades of phenomenal growth, it also had its downsides. In some cases, authoritarian governance was used to suppress labor dissent and push through economic policies. Furthermore, the close ties between government and large corporations, especially in South Korea, led to issues of cronyism and corruption.

A closer look at each tiger

While they shared a common blueprint, each of the Four Asian Tigers leveraged its unique history, culture, and geographic position to forge a distinct economic identity. Understanding these individual paths is crucial for any business looking to engage with these dynamic markets.

South Korea: The miracle on the Han river

From the ashes of the Korean War, South Korea built a global economic powerhouse in a transformation known as the "Miracle on the Han River." Its development was characterized by strong government intervention and a partnership with large, family-owned industrial conglomerates.

- The Chaebol system: South Korea's economy is dominated by large family-owned conglomerates known as Chaebols, such as Samsung, Hyundai, and LG. The government actively supported these Chaebols with preferential loans and policies to drive industrialization in strategic sectors. While instrumental to growth, this system has also been criticized for stifling small and medium-sized enterprises and concentrating economic power.

- Key industries: South Korea is a global leader in high-tech manufacturing. Its major industries include electronics (especially semiconductors), automobile production, shipbuilding, steel, and chemicals. Companies like Samsung and SK Hynix are dominant forces in the global memory chip market.

- Current economic status: As of 2025, South Korea has the 4th largest economy in Asia and the 13th largest in the world. It is a high-income, developed nation and a member of the G20 and OECD. The country faces challenges from an aging population, high household debt, and a slowing in its once-rapid growth.

Taiwan: The silicon island

Taiwan's economic journey, often called the "Taiwan Miracle," saw it transform from an agrarian society into a high-tech, industrialized economy. Its path was distinguished by a focus on flexible small and medium-sized enterprises (SMEs) and a strategic pivot to cutting-edge technology.

- Semiconductor dominance: Taiwan's most critical industry is semiconductor manufacturing. It dominates the global foundry market, which involves contract manufacturing chips for "fabless" design companies. Taiwan Semiconductor Manufacturing Company (TSMC) is the world's largest and most advanced chipmaker, supplying tech giants like Apple and NVIDIA. This dominance has made Taiwan indispensable to the global tech supply chain.

- Key industries: Beyond semiconductors, Taiwan's economy is strong in electronics, machinery, petrochemicals, and information and communications technology (ICT). It has a vibrant ecosystem of tech companies that produce everything from computer components to finished electronics.

- Current economic status: Taiwan is a highly developed, free-market economy. Its export-oriented economy is the 21st-largest in the world by nominal GDP. However, its unique political status and geopolitical tensions present ongoing risks and challenges.

Hong Kong: The global financial hub

Hong Kong's economic success was built on a foundation of free-market principles, low taxation, and its strategic position as a gateway to mainland China.

- Laissez-faire economics: Hong Kong's government has traditionally practiced a policy of "positive non-interventionism," creating a highly favorable business environment. It is characterized by low taxation, almost free port trade, and a well-established international financial market.

- Key industries: Hong Kong's economy is dominated by its services sector. Its Four Key Pillar Industries are financial services, trading and logistics, tourism, and professional services. It is one of the top international financial centers, alongside New York and London, and its stock market is a major destination for capital.

- Current economic status: Hong Kong is one of the world's most services-oriented economies. While its economy remains robust, its role has shifted since the 1997 handover to China. Its share of China's GDP has decreased significantly, and its future growth is increasingly intertwined with the economic and political developments of the mainland.

Singapore: The strategic lion city

Singapore, a small island nation with no natural resources, engineered its economic miracle by leveraging strategic planning, a stable political environment, and an aggressive strategy to attract foreign investment.

- Foreign Direct Investment (FDI) magnet: Unlike the other Tigers, Singapore's industrialization was heavily driven by attracting multinational corporations (MNCs). The government created a secure, low-corruption, and efficient environment with attractive tax incentives, making it a premier destination for foreign direct investment.

- Key industries: Singapore has become a global powerhouse in finance, trade, and logistics. Its port is one of the busiest in the world. It is also a major hub for high-tech manufacturing (including biomedical sciences and electronics) and is a leading financial center in Asia.

- Current economic status: Singapore is a high-income economy with one of the highest GDP per capita rates in the world. Its highly globalized economy is known for its competitiveness, innovation, and skilled workforce. It continues to be a model of how strategic governance can overcome geographic and resource limitations.

Although Vietnam is not among the Four Asian Tigers, it has rapidly emerged as one of Asia’s most promising investment destinations. With a young and dynamic workforce, competitive operating costs, and a government committed to economic reform and international integration, Vietnam offers fertile ground for entrepreneurs and investors. Establishing a company in Vietnam today means positioning your business at the heart of Southeast Asia’s fastest-growing markets, where opportunities span from manufacturing and technology to services and sustainable development.

The 1997 Asian financial crisis and beyond

The seemingly unstoppable growth of the Four Asian Tigers faced its most severe test during the 1997 Asian Financial Crisis. The crisis, which began in Thailand, spread rapidly across the region, exposing vulnerabilities in the Tigers' economic models.

- The impact: The crisis was triggered by a combination of factors, including large foreign debts, risky lending practices, and speculative attacks on local currencies. South Korea was hit the hardest, as its Chaebols were carrying massive amounts of foreign debt. This led to a dramatic currency devaluation and required a significant bailout from the International Monetary Fund (IMF). Hong Kong's stock market and currency also came under intense speculative attacks, forcing unprecedented market interventions by its monetary authority. Singapore and Taiwan were relatively less affected but still felt the regional downturn.

- Resilience and recovery: Despite the severe shock, the Tigers recovered more quickly than many other affected countries. Their resilience was attributed to several factors:

- High savings rates (except for South Korea) provided a capital cushion.

- Their openness to trade and strong export industries allowed them to earn their way out of the crisis.

- They undertook significant economic reforms. South Korea, for example, restructured its Chaebols and reformed its financial sector.

The crisis served as a crucial lesson, leading to stronger financial regulations, improved corporate governance, and a move towards more sustainable growth models. The Tigers also weathered the 2008 Global Financial Crisis, although their export-dependent economies suffered from the sharp decline in American consumption.

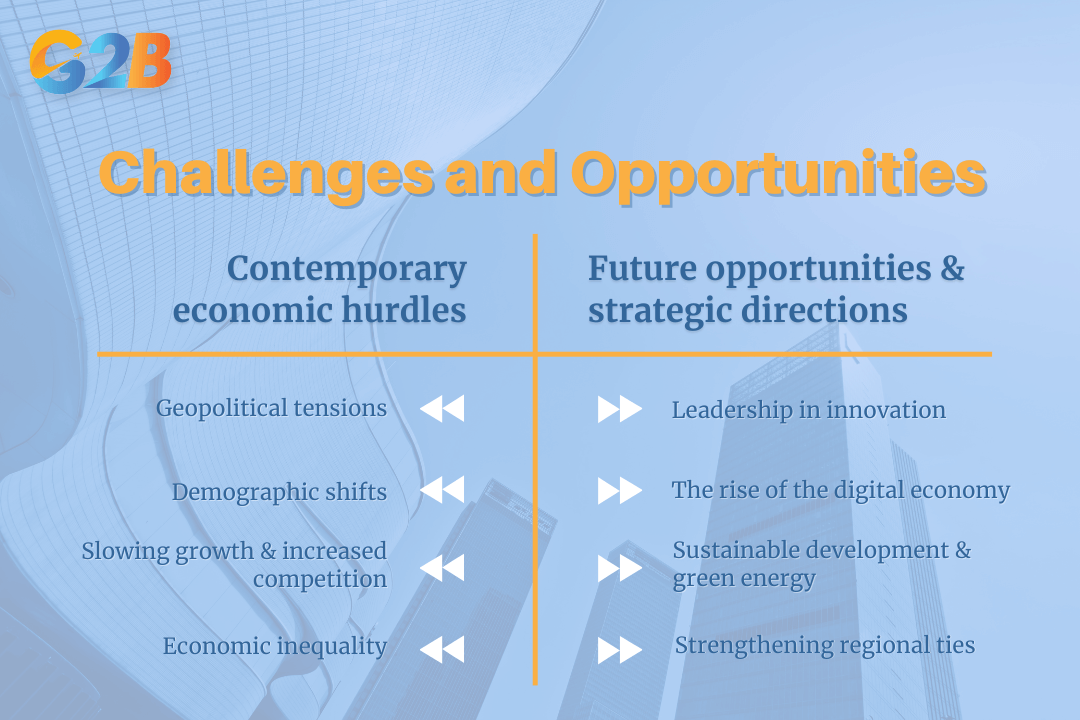

Modern challenges and opportunities in the 21st century

Having transitioned from "miracle" economies to mature, high-income nations, the Four Asian Tigers now face a new set of challenges and opportunities that will define their future. While their foundational strengths remain, they must navigate a more complex global landscape.

The Four Asian Tigers now face a new set of challenges in the 21st century

Contemporary economic hurdles

- Geopolitical tensions: The intensifying rivalry between the United States and China places the Tigers in a difficult position. Taiwan, in particular, is at the center of this geopolitical friction, given its critical role in the semiconductor supply chain and its unresolved political status. South Korea must balance its security alliance with the U.S. and its economic dependence on China. Hong Kong's autonomy and role as a global business hub are being reshaped by its integration with the mainland.

- Demographic shifts: Like many developed nations, the Tigers are grappling with aging populations and declining birth rates. South Korea has the lowest fertility rate in the world, posing a severe long-term challenge to its labor supply, public finances, and economic dynamism. This demographic pressure requires urgent policy solutions related to immigration, retirement, and workforce participation.

- Slowing growth and increased competition: The era of consistent double-digit GDP growth is over. As developed economies, their growth has naturally slowed. They now face intense competition not only from established economies but also from emerging players, including the Tiger Cub Economies, which are leveraging similar export-oriented strategies.

- Economic inequality: Rapid industrialization has led to significant wealth concentration and rising inequality, particularly in South Korea with its dominant Chaebol system. This can lead to social tensions and impact domestic consumption.

Future opportunities and strategic directions

- Leadership in innovation and technology: The future for South Korea and Taiwan lies in moving further up the value chain. Their continued dominance in semiconductors, artificial intelligence (AI), 5G, and next-generation communications is crucial. Taiwan is actively working to become a global center for AI development, while South Korea is investing heavily in biotechnology and AI-driven healthcare.

- The rise of the digital economy: Hong Kong and Singapore are leveraging their strengths as financial hubs to become leaders in FinTech. Hong Kong is also focusing on developing its innovation and technology sector to diversify its economy. Singapore continues to attract tech giants and startups, positioning itself as a hub for the digital economy in Southeast Asia.

- Sustainable development and green energy: Recognizing the environmental impact of industrialization, the Tigers are increasingly focused on sustainability. TSMC, for instance, has pledged to use 100% renewable energy by 2050, a move that is accelerating Taiwan's transition to green power. This push towards sustainability creates new economic opportunities in renewable energy, environmental technology, and green finance.

- Strengthening regional ties: To reduce dependence on single markets, the Tigers are strengthening trade and investment links within Asia and beyond. Taiwan's "New Southbound Policy," for example, aims to deepen ties with Southeast Asia, South Asia, Australia, and New Zealand.

Lessons for global business from the tigers' playbook

The Four Asian Tigers' journey from poverty to prosperity offers a powerful and enduring case study for businesses and developing nations alike. Their strategies, though forged in a different era, contain timeless lessons on growth, resilience, and adaptation that remain highly relevant in today's global economy.

Here are the key takeaways for modern businesses:

- Embrace a global mindset with an export-oriented focus: The Tigers built their success by looking outward. Their relentless focus on producing for export markets forced them to be globally competitive from day one. For businesses today, this means designing products and services that can meet international standards and appeal to a global customer base, rather than being limited by domestic market size.

- Invest relentlessly in human capital: The Tigers understood that their greatest asset was their people. Their heavy investment in education created a highly skilled and adaptable workforce that could power their industrial and technological ambitions. Businesses that prioritize continuous training, skill development, and employee education are better equipped to innovate and navigate economic shifts.

- The power of strategic planning and adaptation: The Tigers were not dogmatic; they were pragmatic. Their governments set clear, long-term economic goals but were flexible enough to adapt their strategies as conditions changed - for example, shifting from low-tech manufacturing to high-value electronics. Successful businesses must also engage in strategic long-term planning while remaining agile enough to pivot in response to new technologies, market trends, and competitive threats.

- Foster a culture of high savings and strategic investment: The high savings rates of the Tigers created a virtuous cycle of investment and growth. For a business, this translates to disciplined financial management. Maintaining a strong balance sheet and strategically reinvesting profits into research and development, technology upgrades, and infrastructure are critical for long-term, sustainable growth.

- Build resilience to overcome crises: The Tigers' ability to recover from the 1997 Asian Financial Crisis demonstrated their underlying economic resilience. They reformed their financial systems, improved corporate governance, and diversified their economies. Businesses must also build resilience by diversifying revenue streams, managing debt effectively, and creating contingency plans to withstand economic shocks and downturns.

The story of the Four Asian Tigers - South Korea, Taiwan, Hong Kong, and Singapore - is a testament to the power of strategic vision, relentless execution, and national will. In a single generation, they transformed themselves from developing economies into global leaders in finance, technology, and trade. Their blueprint, centered on export-oriented industrialization, investment in human capital, and stable governance, created an economic miracle that continues to inspire nations and businesses around the world. While they now face the modern challenges of mature economies, including geopolitical pressures and demographic shifts, their legacy of innovation, resilience, and adaptability continues to drive their success.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom