Foreign Portfolio Investment (FPI) is a vital component of the global economy, allowing investors to participate in foreign markets without taking direct control of companies. It represents the purchase of financial assets - such as stocks and bonds - in a country other than the investor's own, driven by the goals of diversification and financial return. This guide will explore how FPI works, its primary components, its crucial role in economic development, and the risks that accompany its volatile nature.

What is foreign portfolio investment?

Foreign Portfolio Investment (FPI) refers to the acquisition of financial assets in a foreign country where the investor does not gain significant management control or a controlling interest in the company. At its core, FPI is a passive investment, focused on securities that can be bought and sold on public markets. Investors engaging in FPI are primarily seeking returns from capital appreciation, interest payments, or dividends, rather than aiming to influence the day-to-day operations of the foreign enterprise.

This form of investment involves a wide range of foreign financial assets, such as stocks, government bonds, corporate bonds, and mutual funds. The key distinction is the lack of direct ownership of a company's physical assets; the investor owns a paper claim, not the factory or the office building. This makes FPI a more fluid and accessible way for both individual and institutional investors to gain exposure to international economies.

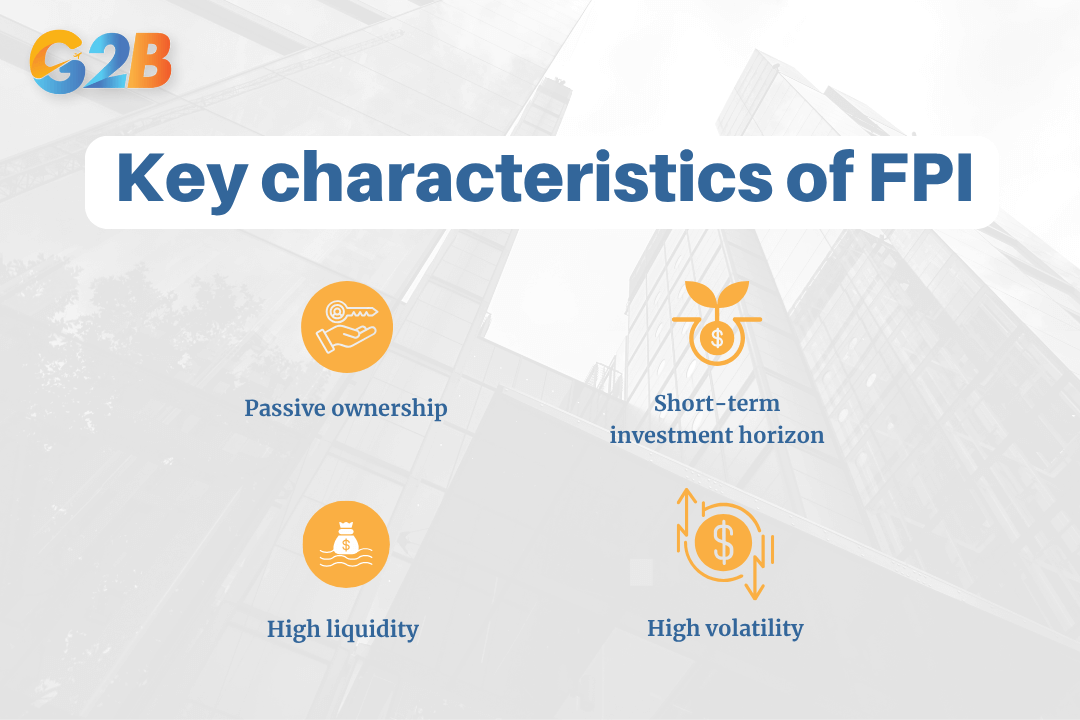

Key characteristics of FPI

Foreign Portfolio Investment is defined by several unique features that distinguish it from other forms of international capital flows. These characteristics influence its behavior, its attractiveness to investors, and its impact on economies.

Foreign Portfolio Investment is defined by several unique features

Passive ownership

The defining feature of FPI is its passive nature. Unlike investors who seek to manage or influence a company's direction, FPI investors are not involved in the operational decision-making of the entities in which they invest. Their ownership stake is purely financial, typically representing less than 10% of a company's voting shares, which is a common threshold used to differentiate it from a direct investment. The primary objective is simply to benefit from the financial performance of the asset.

Short-term investment horizon

FPIs are generally considered short-term investments. Investors can enter and exit markets quickly to capitalize on short-term price movements, interest rate changes, and currency fluctuations. This flexibility is a major draw for portfolio investors who prioritize the ability to react swiftly to changing global market conditions. This short-term focus, however, also contributes to its reputation as "hot money," as capital can flow out of a country just as quickly as it entered.

High liquidity

A direct consequence of its structure is high liquidity. FPI assets, such as publicly traded stocks and bonds, can be easily bought and sold on financial markets. This ability to convert assets into cash with minimal friction or delay is a significant advantage for investors, providing them with the power to adjust their portfolios in response to new opportunities or risks. This contrasts sharply with direct investments in physical assets, which are far more difficult to liquidate.

High volatility

The high liquidity and short-term nature of FPI inherently lead to greater volatility. FPI flows are highly sensitive to shifts in market sentiment, economic news, and political instability in either the host or home country. A sudden change in perception can trigger rapid capital outflows, which can destabilize the host country's financial markets and currency. This volatility is a primary risk associated with FPI, both for the investor and the recipient economy. The volatile nature of FPI requires a robust risk management framework.

FPI vs. FDI: Understanding the key distinctions

While both Foreign Portfolio Investment (FPI) and Foreign Direct Investment (FDI) are channels for international capital flow, they are fundamentally different in their purpose, level of control, and economic impact. Understanding these distinctions is crucial for both investors and policymakers.

The primary distinction between FPI and FDI is that FDI involves obtaining a controlling interest and managerial influence, while FPI is a passive financial investment. An FDI investor aims to build, manage, or significantly influence a business operation in a foreign country, making a long-term commitment. In contrast, an FPI investor purchases financial securities with the goal of earning a return, without any desire for management control.

For maximum clarity, here is a detailed comparison table:

| Basis of Comparison | Foreign Portfolio Investment (FPI) | Foreign Direct Investment (FDI) |

|---|---|---|

| Level of Control | Passive investment with no significant control or management influence. | Active investment with significant control and direct managerial involvement. |

| Investment Horizon | Typically short-term, focused on quick returns and market fluctuations. | Long-term commitment aimed at building or expanding business operations. |

| Liquidity & Reversibility | High. Assets (stocks, bonds) can be sold quickly and easily on public markets. | Low. Physical assets (factories, infrastructure) are difficult and slow to liquidate. |

| Objective | Portfolio diversification and capital appreciation through financial returns. | Establishing a lasting business interest, market entry, or expanding operations. |

| Risk Profile | Exposed to market volatility, currency risk, and sudden sentiment shifts. | Exposed to geopolitical, regulatory, and operational risks over the long term. |

| Economic Impact | Increases market liquidity and capital availability but can be unstable ("hot money"). | Considered more stable; fosters job creation, technology transfer, and infrastructure development. |

In essence, an FDI investor is like someone buying a house abroad to manage it as a rental property - a long-term, illiquid, and hands-on asset. An FPI investor is more like someone buying shares in a foreign real estate company - a liquid, passive investment that can be sold at a moment's notice.

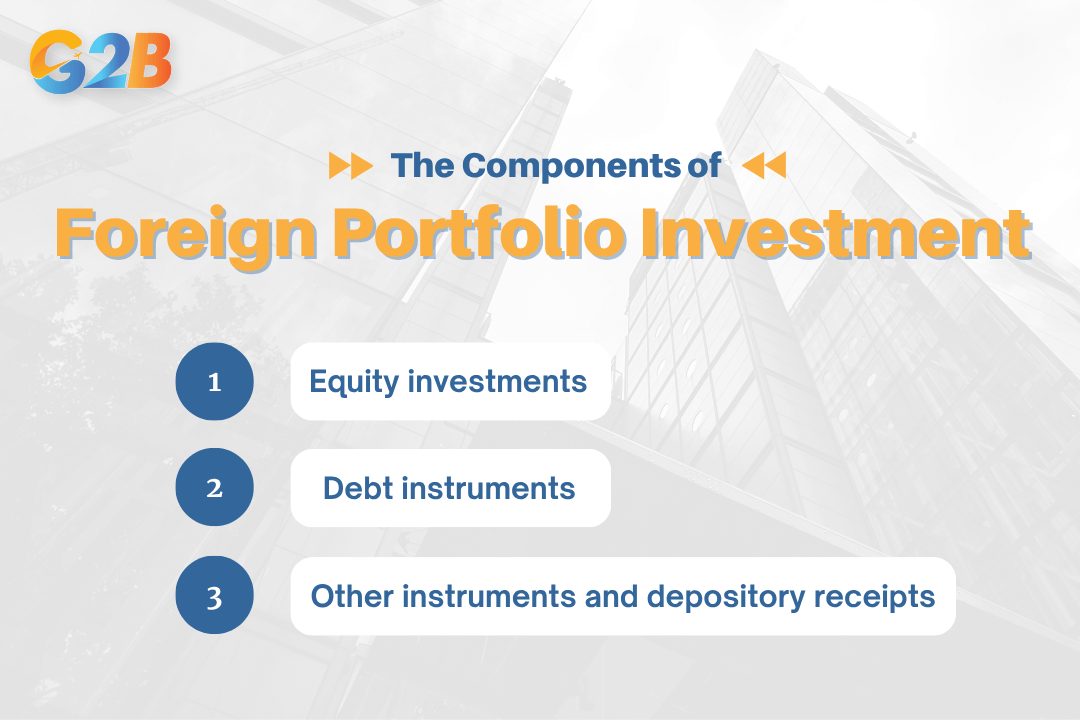

Components of foreign portfolio investment

Foreign Portfolio Investment is not a single asset but a category that encompasses a diverse range of tradable financial instruments. These components allow investors to tailor their foreign exposure based on their risk appetite and investment strategy.

Foreign Portfolio Investment encompasses a diverse range of tradable financial instruments

Equity investments

This is the most common form of FPI. Equity investments come in many forms, such as common stocks, preferred stocks, and units of exchange-traded funds (ETFs). When an investor buys shares of a foreign company listed on a stock exchange, they are making an equity-based FPI. This gives them ownership in the company and a claim on its future profits (dividends) and capital growth, without direct involvement in its management.

Debt instruments

Investors also use FPI to buy a variety of debt instruments, such as sovereign bonds, municipal bonds, and corporate bonds. In this case, the investor is essentially lending money to a foreign government or corporation in exchange for regular interest payments and the return of the principal amount at maturity. Debt-based FPI is often seen as less risky than equity, providing a stream of fixed income.

Other instruments and depository receipts

FPI also includes other financial products that provide exposure to foreign markets. These can include various mutual funds, derivatives, and certificates of deposit (CDs) or guaranteed investment certificates (GICs). A particularly important component for international investors is Depository Receipts (DRs).

- What are depository receipts? A depository receipt is a negotiable certificate issued by a bank that represents shares in a foreign company. It allows investors to buy and trade ownership in a foreign corporation on their local stock exchange.

- American depositary receipts (ADRS): These are DRs that trade on U.S. stock exchanges, like the NYSE or NASDAQ. An ADR makes it simple for American investors to purchase stock in foreign companies without dealing with cross-border transaction complexities.

- Global depositary receipts (GDRS): A GDR is similar to an ADR but is typically listed on exchanges outside the U.S., such as in London or Luxembourg. They are offered to investors in multiple countries simultaneously, facilitating broader international investment.

The crucial role and benefits of FPI

Foreign Portfolio Investment plays a dual role in the global economy, offering significant advantages to both the investors who provide the capital and the host countries that receive it.

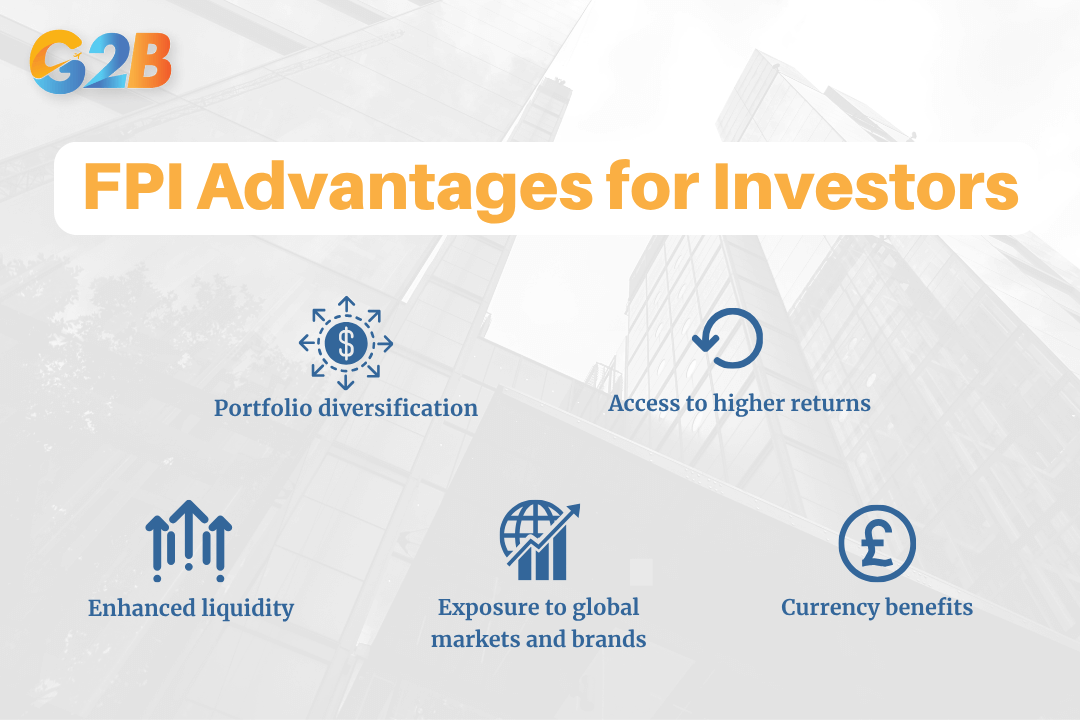

Advantages for investors

For investors, FPI is a powerful tool for achieving strategic financial objectives.

- Portfolio diversification: The primary benefit of FPI is the ability to diversify investments across different countries, economies, and currencies. By holding assets in multiple international markets, investors can reduce their overall portfolio risk, as a downturn in one country's market may be offset by growth in another.

- Access to higher returns: Emerging markets and high-growth economies can offer greater return potential than more mature domestic markets. FPI provides a liquid and accessible pathway for investors to tap into this growth.

- Enhanced liquidity: FPI assets are generally highly liquid, allowing investors to enter and exit positions quickly to capitalize on opportunities or mitigate risks.

- Exposure to global markets and brands: FPI allows individuals and institutions to invest in globally recognized companies and industries that may not be available in their home market, broadening their investment universe.

- Currency benefits: By holding assets denominated in foreign currencies, investors can benefit from favorable movements in exchange rates, adding another potential source of return.

Foreign Portfolio Investment plays a dual role for investors

Importance for host countries

For the economies receiving the investment, FPI is a critical source of capital and a catalyst for financial market development.

- Infusion of capital: FPI brings substantial capital inflows into a country's financial markets. This capital can be used to fund business expansion, support new projects, and drive economic growth.

- Increased market liquidity and efficiency: The participation of foreign investors increases trading volumes, which enhances the liquidity and depth of domestic capital markets. This makes it easier and cheaper for local companies to raise capital and can lead to more efficient price discovery.

- Boosts foreign exchange reserves: The inflow of foreign currency strengthens the host country's foreign exchange reserves. These reserves are crucial for maintaining economic stability and managing the country's balance of payments.

- Development of the financial sector: To attract and retain FPI, countries are often encouraged to improve their financial infrastructure, regulatory frameworks, and corporate governance standards, leading to a more robust and sophisticated financial system.

Foreign Portfolio Investment is a cornerstone of modern international finance. It is characterized by its passive nature, short-term horizon, and high liquidity, which sets it apart from the long-term, controlling stake of Foreign Direct Investment. For developing economies, initiatives promoting company formation in Vietnam and other investment-friendly policies have played a key role in attracting foreign capital, driving market growth, and strengthening financial stability. While its inherent volatility presents risks that require careful management, the role of FPI in creating a more interconnected and efficient global financial system is undeniable.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom