To support entrepreneurs in navigating the variety of business structures available today, this article takes a closer look at the Special Purpose Vehicle (SPV) - a flexible and strategic option that can offer greater control, protection, and efficiency in business operations. As these entities are pivotal in risk isolation and tax efficiencies, grasping their significance can unlock myriad opportunities in structured financing. Let’s take a closer look at why an SPV company could be a structure worth considering.

Definition and purpose of special purpose vehicle companies

An SPV, also known as a special purpose entity (SPE), is created to isolate financial risk by segregating certain assets and liabilities from the parent company's balance sheet.

What is a special purpose vehicle company?

A special purpose vehicle (SPV) company is a legally distinct entity created to fulfill a particular, predefined purpose - usually to isolate financial risk, manage a single investment, or hold specific assets. Unlike standard companies, SPVs are not designed for ongoing, diversified business operations. Instead, they are typically set up for a singular, narrowly defined task. In practice, an SPV might be used by corporations to pool resources for large infrastructure projects or by financial institutions to issue mortgage-backed securities.

The distinct purposes and objectives of SPVs

- Risk isolation: One of the primary reasons for establishing an SPV is to ring-fence financial risk. By legally separating assets, the parent company can protect itself from potential losses. This is particularly beneficial in high-risk ventures where insulating the parent company's core operations from potential failure is crucial.

- Asset securitization: SPVs are commonly employed in the process of securitization, where financial assets, such as loans or receivables, are pooled and transformed into tradable securities. This allows companies to unlock liquidity and access additional financing channels without disrupting their core capital structure.

- Financing and investment: SPVs are often utilized in structured finance arrangements to secure financing for specific projects or ventures. They serve as vehicles through which capital is raised and managed, providing a mechanism to facilitate large-scale, capital-intensive endeavors like real estate developments or infrastructure projects.

- Tax efficiency: Certain jurisdictions offer favorable tax treatment for SPVs, allowing companies to leverage these structures for tax optimization purposes. By housing specific assets or operations within an SPV in a tax-friendly location, businesses can potentially reduce their tax liabilities.

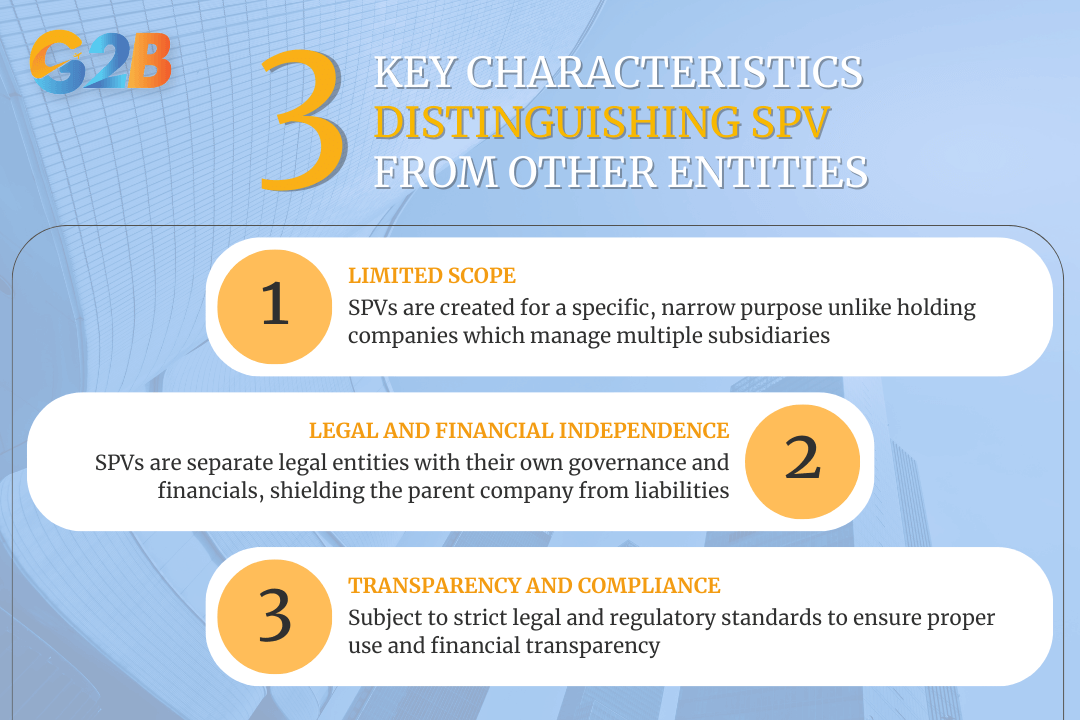

Key characteristics distinguishing SPVs from other entities

- Limited scope: Unlike a holding company, which may oversee multiple subsidiaries and offer strategic oversight, an SPV is narrowly focused on a specific purpose. This focused mandate ensures its operations remain streamlined and aligned with its founding objective.

- Legal and financial independence: An SPV operates independently of its parent company. This independence is legally codified, often maintaining its own financial statements and governance, thereby preventing cross-contamination of obligations between the parent and the SPV.

- Transparency and compliance: SPVs are subject to rigorous regulatory scrutiny to prevent misuse, such as in cases of financial manipulation or off-balance-sheet financing. Consequently, they must adhere strictly to both jurisdictional legal requirements and international standards of financial transparency.

Special purpose vehicle companies are powerful instruments within corporate and financial strategy, providing mechanisms for risk mitigation, asset management, and capital optimization. Through their carefully defined structure and purpose, SPVs play a pivotal role in enabling complex financial operations and fostering growth in various sectors.

SPVs have unique structural and legal features that set them apart from other entities

Benefits and use cases of SPVs

The benefits of SPVs make them a critical component in modern finance and investment strategies, offering flexibility and risk isolation.

Risk isolation and asset protection benefits

One of the paramount advantages of SPVs is their ability to isolate risk. By setting up an SPV, parent companies can segregate financial exposure and protect assets from unnecessary risks. This feature is especially advantageous in sectors where large-scale investments are prone to fluctuate, such as distressed asset acquisition or high-stakes ventures. This isolation safeguards corporate interests while simultaneously fostering an environment for strategic risk-taking and innovation.

Financing and capital raising strategies

SPVs are fundamental in optimizing financing avenues and capital raising endeavors. As separate entities, they can issue debt independently, making them an attractive vehicle for structuring complex financial products such as asset-backed securities. Investment banks often encounter SPVs as instrumental in securitization processes, wherein the SPV issues securities backed by asset pools, releasing liquidity and fostering capital mobilization. This structural flexibility facilitates new opportunities for investors by offering investment grades tailored to diverse risk appetites.

Tax optimization possibilities

The structured nature of SPVs offers viable tax optimization strategies, addressing the intricate needs of multinational firms and investment consortiums. With valid legal guidance from tax consultants, entities can exploit jurisdictional benefits, effectively minimizing tax liabilities. SPVs can be strategically domiciled in regions with favorable tax treaties, benefiting from reduced withholding taxes on cross-border transactions. This fiscal efficiency enhances overall investment returns and maximizes shareholder value, establishing SPVs as a quintessential component of tax-efficient corporate strategies.

Application in real estate and investment projects

SPVs find a vital application in real estate and large investment projects. Real estate developers, for instance, deploy SPVs to structure distinct entities for individual projects, delineating project-specific financial and legal obligations. Utilizing SPVs in investment projects insulates parent corporations from the direct financial impact, preserving core business functions and assets. This advantage is crucial in diverse sectors including construction, technology, and energy, where project-based venture management is pivotal in driving innovation and competitiveness.

Legal and regulatory framework for SPV formation

The formation of a Special Purpose Vehicle (SPV) company is critically dependent on navigating a complex legal and regulatory framework. Understanding the regulatory environment, meeting legal requirements, and ensuring compliance with ongoing obligations are essential for leveraging SPVs effectively.

Understanding the regulatory environment

The regulatory environment for SPVs can be intricate, often influenced by both national and international laws. Commonly, SPVs are structured in jurisdictions that offer favorable regulatory conditions, and these can vary significantly:

- Jurisdictional variances: Some regions, like the Cayman Islands or Luxembourg, provide an accommodating climate for SPV registration due to their lenient regulatory policies, tax benefits, and privacy norms.

- International standards: Global regulations such as the International Financial Reporting Standards (IFRS) or Basel III Accord might impact how SPVs operate, especially if they are used for structured finance transactions.

- Industry-specific regulations: Depending on the sector an SPV serves, such as real estate or asset securitization, industry-specific rules may apply, impacting formation and operations.

Legal requirements and documentation needed

Legal requirements for setting up an SPV are meticulous and necessitate a thorough understanding of the relevant documentation involved:

- Articles of incorporation: These foundational documents outline the SPV's purpose, powers, and governance. Precise articulation is crucial as it defines the scope and limitations of the SPV's activities.

- Shareholder agreements: Stipulated agreements are required to establish shareholder roles, equity distribution, and control measures.

- Regulatory filings: Registration with regulatory bodies like the Securities and Exchange Commission (SEC) in the United States is mandatory for SPVs involved in securitization or public offerings.

- Tax documentation: Proper assessment and engagement with tax consultants ensure tax obligations are optimized - a critical component, given the potential tax savings highlighted in recent industry reports.

Compliance and ongoing obligations

Compliance doesn’t end at formation - SPVs must adhere to numerous ongoing obligations to maintain their legal status:

- Reporting requirements: Regular submission of financial statements and other disclosures to regulatory authorities is standard. This ensures transparency and adherence to financial laws.

- Audit mandates: Periodic audits by certified professionals are often required to verify financial health and compliance with regulations.

- Corporate governance: Ensuring robust governance structures, including a board of directors or appointed representatives, is essential to uphold fiduciary responsibilities and mitigate risks.

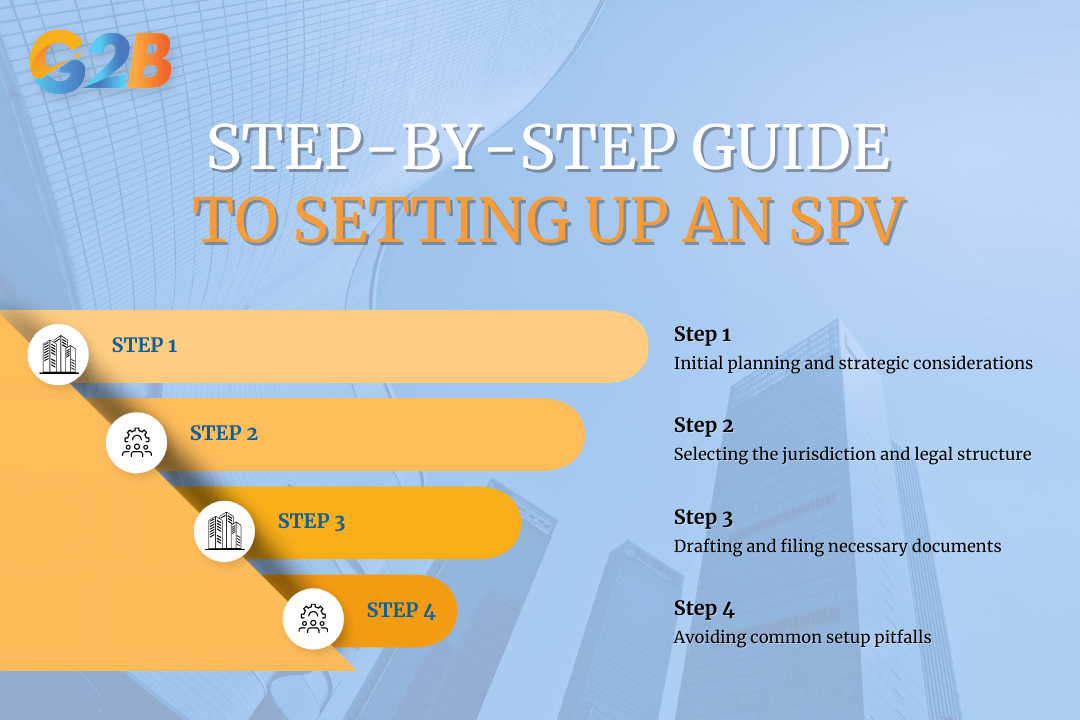

Step-by-step guide to setting up a special purpose vehicle

This guide outlines the essential steps to help you navigate the process of establishing a special purpose vehicle (SPV) effectively.

This step-by-step guide explains how to set up a special-purpose vehicle

Initial planning and strategic considerations

The inception of an SPV starts with rigorous planning and strategic considerations. Before diving into the legal nuances, it's crucial to define the specific purpose of your SPV. Whether the aim is asset securitization, risk isolation, or a distinct financial objective, clarity in the mission is paramount.

- Define objectives: Clearly outline the goals the SPV will fulfill. This may include isolating assets for a large real estate project or managing a segment of business risk.

- Risk assessment: Conduct a thorough risk analysis. Evaluate potential financial risks and how the SPV will mitigate them.

- Stakeholder engagement: Engage relevant stakeholders early on, including financial advisors, legal experts, and tax consultants, to gain a comprehensive understanding of the commitments involved.

Selecting the jurisdiction and legal structure

Jurisdiction plays a pivotal role in the flexibility and efficiency of an SPV. Different jurisdictions offer varied benefits in terms of tax incentives, regulatory environments, and legal protections.

- Jurisdiction selection: Choose a jurisdiction that aligns with your strategic goals. Consider factors such as tax rates, regulatory requirements, and local economic conditions. Popular jurisdictions for SPVs include Delaware in the U.S., Luxembourg, and the Cayman Islands due to their favorable legal frameworks.

- Legal structure: Decide on an appropriate legal structure. Options include limited liability companies (LLCs), trusts, or corporations. The choice depends on the SPV's purpose and the level of liability protection required.

Drafting and filing necessary documents

Once the jurisdiction and structure are determined, the next step involves drafting and filing the requisite legal documents.

- Legal documentation: This includes the articles of incorporation, operating agreements, and any specific contracts pertaining to the SPV's activities. Each document should clearly reflect the SPV's purpose and operational guidelines.

- Regulatory compliance: Ensure compliance with local regulations, including registration with government bodies and submission of necessary financial disclosures.

- Expert consultation: Employ the services of legal experts familiar with SPV formation in the chosen jurisdiction to avoid potential pitfalls and to ensure all legalities are covered comprehensively.

Avoiding common setup pitfalls

Setting up an SPV can be complex, and avoiding common mistakes is crucial for a smooth establishment.

- Overlooking compliance: One significant risk is failing to adhere to ongoing compliance requirements. SPVs are subject to various regulatory frameworks, and non-compliance can lead to legal challenges.

- Insufficient capitalization: Ensure the SPV has adequate capitalization. Insufficient funds can hamper its ability to function effectively.

- Ambiguous objectives: Avoid vague or overly broad objectives. Without a clear focus, the SPV may struggle to fulfill its intended purpose, leading to strategic misalignments.

- Inadequate documentation: Ensure that all documents are meticulously drafted and reviewed by legal professionals to prevent future disputes or misunderstandings.

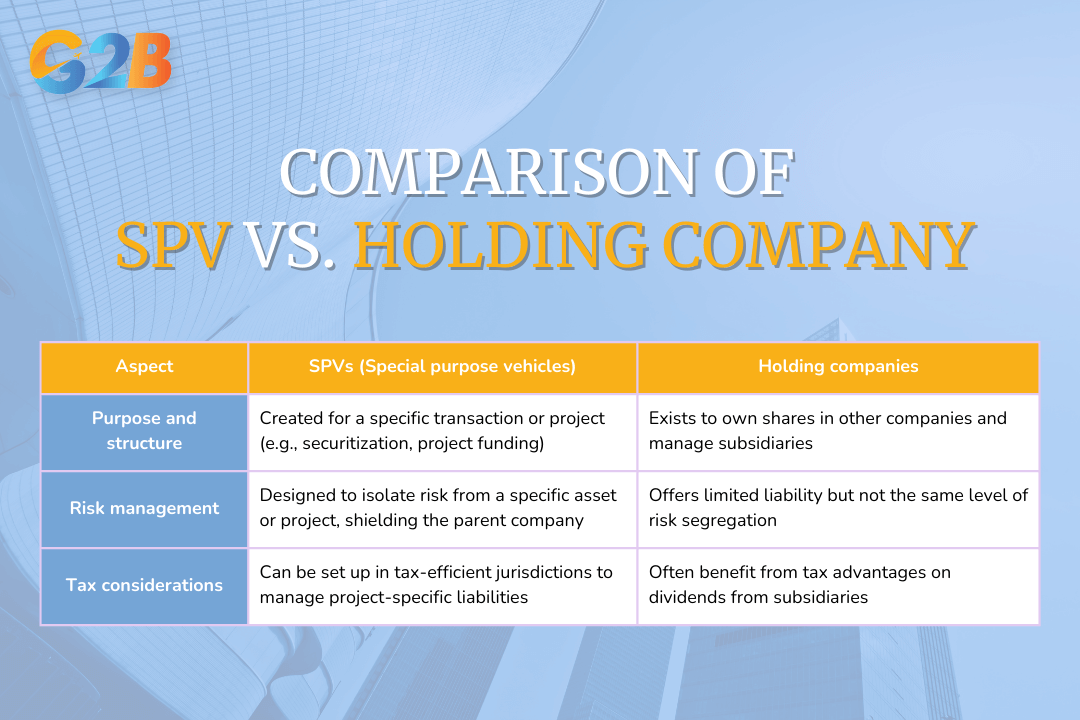

Comparison of SPVs with other corporate structures

This paragraph highlights the advantages and disadvantages of Special Purpose Vehicles (SPVs) in various contexts to provide a comprehensive understanding for entrepreneurs.

SPVs vs. holding companies

- Purpose and structure: While both SPVs and holding companies manage assets and liabilities, their purposes diverge significantly. An SPV is typically created for a singular transactional purpose, such as isolating risk in a securitization deal or funding a specific project. In contrast, a holding company exists to own shares in other companies. It provides strategic management and control over its subsidiaries, taking a more long-term approach in managing diversified investments.

- Risk management: SPVs are commonly used for risk isolation, enabling organizations to ring-fence the risks associated with a specific asset or project. This protects the parent organization’s balance sheet from potential downsides. Holding companies, although benefiting from limited liability, do not inherently provide the same level of risk segregation due to their broad asset management focus.

- Tax considerations: Both structures can offer tax advantages. SPVs can be established in tax-friendly jurisdictions to manage liability from specific projects, while holding companies often benefit from tax efficiencies through dividends received from subsidiaries not being subject to additional corporate taxes.

This comparison highlights the main differences between special purpose vehicles and holding companies

SPVs vs. structured finance entities

- Financial objectives: SPVs are frequently utilized in structured finance as entities designed solely for the securitization of assets. This involves turning a pool of assets into marketable securities, thus offering liquidity and risk transference. Structured finance entities are often broader in scope, potentially encompassing a variety of financing activities, including collateralized debt obligations or asset-backed securities.

- Legal and regulatory differences: SPVs often enjoy more streamlined regulatory processes as they focus on specific projects. However, compliance with strict securitization and capital markets regulations is necessary. Structured finance entities might face more comprehensive regulatory scrutiny given their broader financial activities and integration with broader capital markets.

- Operational complexity: The singular focus of SPVs can make operational management relatively straightforward once established. On the other hand, structured finance entities often require extensive infrastructure for ongoing administration and regulatory compliance due to their complex financial activities.

Advantages and disadvantages in different contexts

While SPVs provide unique strategic advantages, particularly in risk management and financial efficiency, they require careful consideration in comparison to other corporate structures.

Advantages:

- Risk isolation: SPVs allow firms to compartmentalize financial risk, protecting the primary business from potential volatility or losses associated with specific projects.

- Asset management and financing flexibility: They provide tailored financial vehicles to raise capital efficiently without leveraging the core business's balance sheet.

- Strategic tax benefits: With international tax planning, SPVs can be structured to optimize tax liabilities across jurisdictions.

Disadvantages:

- Limited operational scope: Their singular focus might restrict scalability beyond the original project or transaction's life.

- Increased scrutiny: Since the Enron scandal, SPVs have been under tight observation by regulatory authorities, necessitating stringent adherence to ethical and financial standards.

- Setup and management complexity: Establishing an SPV involves considerable legal, financial, and administrative efforts, potentially outweighing benefits in smaller transactions.

Frequently asked questions about special purpose vehicle companies

Some of the most FAQs about special purpose vehicle companies, including common misconceptions surrounding their structure, and how they influence a company’s financial statements.

What are the common misconceptions about SPVs?

One prevalent misconception about special purpose vehicles (SPVs) is that they are primarily tools for legal evasion or unethical practices. However, legitimate SPVs are established for sound business purposes like risk isolation and asset management, backed by legal frameworks and regulatory oversight.

Another common misunderstanding is that SPVs are only used for complex financial transactions like asset securitization. While securitization is a significant application, SPVs also play crucial roles in joint ventures, real estate projects, and infrastructure developments. They offer a way to streamline operations, enhance financing capabilities, and optimize tax structures in various industries.

Additionally, many perceive SPVs as overly complex entities that only large corporations can manage. In reality, SPVs can be tailored to fit smaller-scale projects and businesses, leveraging their benefits without unnecessary complication. The sophisticated nature of SPVs is more about precision in achieving specific goals rather than complexity for complexity’s sake.

How do SPVs impact financial statements?

SPVs can significantly impact a company’s financial statements, particularly in terms of asset and liability management. When assets are transferred to an SPV, they are often removed from the balance sheet of the parent company. This off-balance-sheet treatment helps in presenting a clearer and, sometimes, more favorable financial position for the parent company by reducing apparent leverage and enhancing key financial ratios.

The key to proper financial statement impact lies in the consolidation of SPV results. According to International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), the requirement to consolidate an SPV depends on control and risk-sharing factors. If the parent company retains significant control over the SPV, it may need to consolidate the SPV's financials, reflecting more accurate asset and liability positions on consolidated statements.

However, it’s essential to approach the impact of SPVs on financial statements with a full understanding of applicable accounting standards. Misapplication can lead to erroneous financial reporting and regulatory non-compliance, highlighting the need for skilled financial and legal advisory in the setup and ongoing management of SPVs.

What are the risks and challenges in using SPVs?

One key risk is the potential for reputational damage. If an SPV is perceived as a vehicle for obscuring financial reality or engaging in aggressive tax avoidance, it can harm the parent company’s reputation. This scenario underscores the importance of maintaining transparency and adhering to ethical guidelines.

Another challenge involves regulatory compliance. SPVs are subject to strict legal and regulatory requirements that vary by jurisdiction. Navigating these intricacies requires a thorough understanding and meticulous documentation to avoid legal pitfalls, mandatory disclosures, and potential sanctions.

Finally, the financial arrangements within SPVs pose risk management challenges. If structured improperly, SPVs can incur unforeseen losses. Effective risk mitigation strategies include engaging experienced financial experts and ensuring robust corporate governance to oversee SPV activities.

Special purpose vehicle companies play a vital role in modern corporate finance, offering businesses a flexible and strategic tool to manage risk, structure investments, isolate liabilities, and optimize tax exposure. Whether used for project financing, asset securitization, or offshore structuring, SPVs can unlock significant advantages when set up with a clear purpose, strong governance, and legal compliance.

With its stable legal system, large consumer market, and business-friendly regulations, the United States offers a highly attractive environment for entrepreneurs and investors looking to establish a company. If you want to establish a presence in the US market, G2B offers Delaware offshore company formation service, providing tailored support and strategic guidance every step of the way. Contact G2B to open the door to new opportunities!

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  Ras Al Khaimah (UAE)

Ras Al Khaimah (UAE)  United Kingdom

United Kingdom