Selecting the appropriate corporate structure - C Corporation or S Corporation - is a pivotal decision that can shape your business's financial trajectory. Many startups favor C Corporations because they can attract a broad investor base. Conversely, S Corporations appeal to business owners seeking pass-through taxation. Understanding these distinctions is essential for aligning your corporate structure with your long-term strategic objectives.

Overview of C Corporations and S Corporations

These two corporate entities, while similar in providing limited liability protection, differ significantly in their taxation structures, ownership rules, and compliance requirements.

C Corporation - Definition and purpose

A C Corporation (C Corp) is a legal entity that exists separately from its owners, offering limited liability protection. This means that shareholders are typically not personally responsible for business debts and liabilities. The primary purpose of a C Corp is to generate profit for its shareholders, and it is characterized by its ability to raise capital through the issuance of stocks. Importantly, C Corps are taxed as separate entities under the U.S. tax code, which means they face double taxation, and shareholders also pay taxes on any dividends they receive.

S Corporation - Definition and purpose

An S Corporation (S Corp) is a special tax designation available to eligible small businesses. Like C Corps, S Corps also provide limited liability protection to their shareholders. Instead of being taxed as a separate entity, an S Corp allows income, deductions, and credits to pass through to shareholders, who then report this information on their personal tax returns. This avoids the issue of double taxation. However, S Corps must meet specific IRS criteria, including having no more than 100 shareholders and restricting ownership to U.S. citizens and residents. Moreover, they can have only one class of stock, limiting the flexibility in ownership structures.

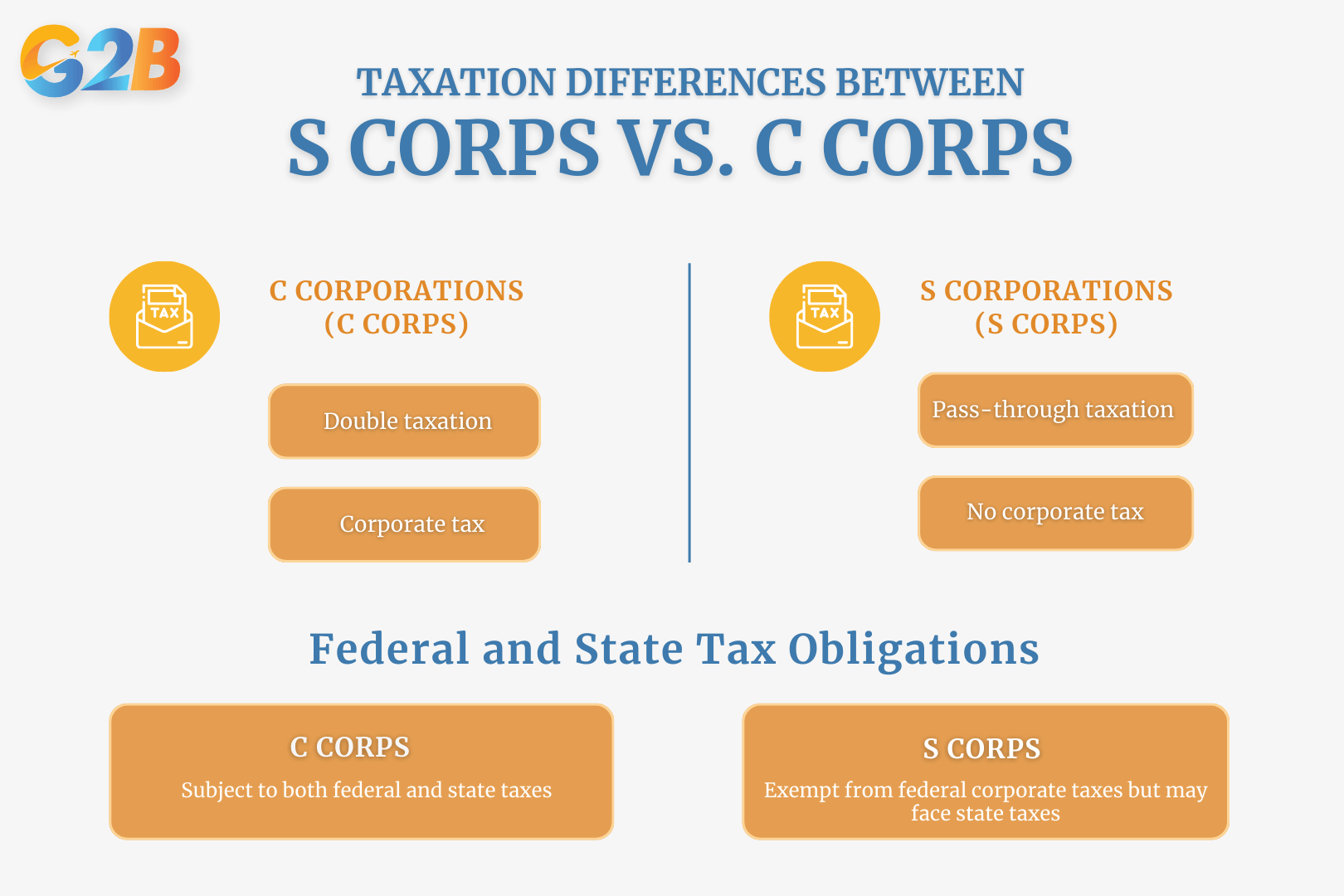

Taxation differences between C Corps and S Corps

This section will delve into the complexities of double taxation in C Corporations, pass-through taxation in S Corporations, and the federal and state tax obligations that differentiate these entities.

There are many differences in taxation between C Corps and S Corps

Double taxation in C Corporations

C Corporations are distinct legal entities, and one of their most notable tax implications is double taxation. This occurs because the corporation's profits are taxed at both the corporate level and again at the individual level when dividends are distributed to shareholders. Here's how it works in simple terms:

- Corporate tax: C Corporations are subject to a federal corporate tax rate. This rate applies to the profits the corporation makes before any dividends are given out.

- Dividend tax: Once the corporation decides to distribute dividends to shareholders, those dividends are taxed again at the individual recipient's tax rate.

Pass-through taxation in S Corporations

S Corporations benefit from a pass-through taxation model, which avoids the double taxation burden. This structure allows income to pass directly to shareholders, who report it on their personal tax returns. The mechanics of pass-through taxation include:

- No corporate tax: S Corporations do not pay federal income taxes at the corporate level. Instead, all profits or losses are reported on the individual shareholders’ tax returns.

- Schedule K-1: Each shareholder receives a Schedule K-1, which details their share of the company's income, deductions, and credits. This information is used to fill out their individual tax returns, combining business income with other personal income, to determine their total tax liability.

Federal and state tax obligations

Beyond the fundamental differences in taxation structures, both C Corporations and S Corporations face distinct federal and state tax obligations that potential incorporators must consider.

- C Corporations: Apart from federal taxes, C Corporations might be subject to specific state corporate taxes, which vary greatly across different jurisdictions. Additionally, C Corps are responsible for paying state taxes on their profits, potentially facing further tax liabilities depending on state regulations.

- S Corporations: While S Corporations are exempt from federal corporate taxes, they are not entirely free from state-level taxation. Some states recognize the federal S Corp status and treat it similarly in terms of pass-through taxation. However, others might still impose a state tax at the entity level, or require an S Corp to pay a minimum franchise tax.

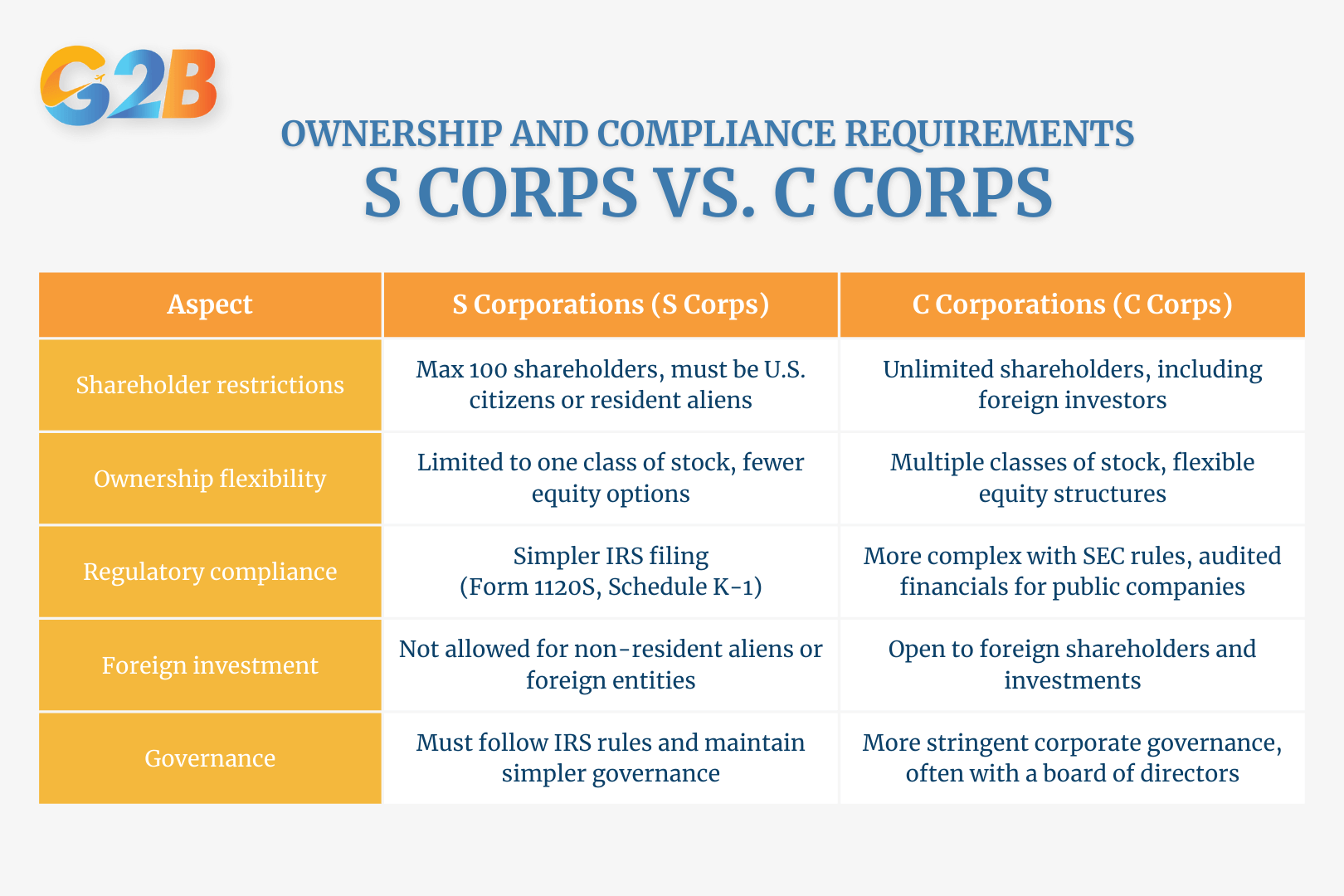

Ownership and compliance requirements

While both corporate structures provide the benefit of limited liability, they differ significantly in terms of shareholder eligibility, ownership flexibility, and regulatory obligations.

There are 5 ownership and compliance requirements of S Corps and C Corps

Shareholder restrictions for S Corps

S Corporations are stringently bound by the IRS regulations, primarily centered on ownership limits and qualifications. One of the foremost restrictions is the limitation on the number of shareholders to no more than 100. This constraint ensures simpler administrative processes but might hinder growth prospects for companies eyeing extensive capital raising. Furthermore, S Corps can only have U.S. citizens or resident aliens as shareholders, ruling out foreign investment opportunities, which could be a critical factor for businesses with global ambitions.

Additionally, S Corps are limited to issuing only a single class of stock. This restriction may impact the firm's ability to entice investors who seek different levels of dividend preference or voting rights. The uniformity of stock class underscores a straightforward approach but might be considered an impediment for entities requiring complex equity arrangements. The IRS's stringent eligibility criteria implicitly demand careful planning and legal consultation during the S Corp establishment phase to ensure adherence and optimize shareholder advantages.

Ownership flexibility in C Corps

C Corporations, offering considerably greater ownership flexibility, serve as a preferred structure for larger or more complex businesses aspiring to scale. They can have an unlimited number of shareholders, which inherently supports extensive fundraising activities and facilitates inclusion of institutional investors. This characteristic makes C Corps particularly appealing to startups, paving the way for substantial venture capital investments.

Moreover, C Corps do not face the same national residency restrictions as S Corps, allowing them to include foreign shareholders. This global openness broadens the horizon for foreign direct investment and can be advantageous for companies seeking international partnerships or entering foreign markets. C Corps also possess the capability to issue multiple classes of stock. This provision enables the company to craft intricate equity structures that might feature varying dividend payments or voting rights arrangements.

Regulatory compliance and corporate governance

Both C Corps and S Corps are subject to specific regulatory compliance measures, although the complexity and nature vary notably. C Corporations face more rigorous reporting and governance obligations due to their potential for public trading. Regular filing requirements include audited financial statements and adherence to Securities and Exchange Commission (SEC) regulations if they are publicly traded, coupled with stringent adherence to corporate governance best practices.

S Corporations, although enjoying simpler tax structures, must still comply with IRS mandates, including the timely filing of Form 1120S and distribution of Schedule K-1 to shareholders, detailing individual income from the corporation. Despite a relatively lower compliance burden compared to C Corps, maintaining accurate payroll and employment tax filings to avoid penalties remains essential. The overarching corporate governance framework for both corporate types typically involves drafting bylaws, maintaining a board of directors, and conducting regular meetings.

Pros and cons of C Corporations

C Corporations offer distinct benefits and drawbacks that can significantly affect a business’s taxation, growth potential, and regulatory compliance. Understanding these aspects is crucial for businesses considering this structure.

Advantages of forming a C Corp

C corporations (C corps) are a popular choice among businesses, particularly those looking to scale rapidly and attract investment. One of the primary advantages is the ability to raise capital. C corps can issue multiple classes of stock to an unlimited number of shareholders, including institutional investors and foreign entities. Another benefit is the limited liability protection it offers. Shareholders' personal assets are typically protected from business debts and legal judgments.

This separates personal finances from the company's financial obligations, which is a critical consideration for any entrepreneur. Additionally, tax-wise rate can be advantageous when comparing it to individual tax obligations, especially for higher-income brackets. C corps can take advantage of a wider range of tax deductions and credits, including benefits related to healthcare and retirement plans, which can be instrumental in managing operational costs.

Disadvantages of C Corporations

Despite these advantages, C corporations also face notable disadvantages, particularly concerning taxation. One of the most significant downsides is double taxation. The C Corp's earnings are taxed at the corporate level, and any dividends distributed to shareholders are taxed again at the individual level. This can reduce the overall profitability and attractiveness of the business, making it a less appealing choice for some small business owners.

Compliance and regulatory requirements for C Corps can be strenuous. They are subject to strict corporate governance rules, including mandatory board of directors meetings, annual shareholder meetings, and extensive record-keeping. These demands can increase administrative burdens and costs, making it less suitable for smaller operations or those with limited resources. Lastly, profit distribution among shareholders is strictly regulated under C Corp guidelines, often requiring complex stock class structuring and dividend distribution policies.

Pros and cons of S Corporations

S Corporations provide specific advantages and limitations that influence taxation, ownership structure, and operational flexibility. Understanding these key factors is essential for businesses considering this structure.

Benefits of electing S Corp status

S Corporations offer several notable benefits, mainly tied to taxation and liability:

- Pass-through taxation: One of the most significant advantages is the pass-through taxation mechanism. Unlike C Corporations that face double taxation - once at the corporate level and again at the shareholder level - S Corps enable income to flow directly to shareholders.

- Liability protection: Shareholders enjoy liability protection, which means personal assets are protected from the company's debts and liabilities. This is parallel to the protection offered by C Corporations, strengthening the argument for S Corp's utility in high-liability industries.

Drawbacks of S Corporations

Despite the appealing benefits, S Corporations come with several restrictions and disadvantages that could deter potential business owners:

- Shareholder limitations: S Corporations face a strict limitation on the number and type of shareholders. They are capped at 100 shareholders, who must all be U.S. citizens or residents. This restriction can stifle growth opportunities, especially for businesses looking to expand through international investments.

- Single class of stock: S Corps are limited to issuing only one class of stock, which may hinder financial flexibility and limit the types of equity financing strategies available. Unlike C Corps, which can issue multiple stock classes to attract diverse investment, S Corps must be cautious in structuring their equity offerings.

- Compliance and administrative burden: While not as extensive as C Corps, S Corporations do have to meet specific IRS obligations. These include filing Form 1120S and issuing Schedule K-1 to all shareholders. Furthermore, retaining earnings within the company can be more difficult due to the distribution requirements.

Optimal situations for S Corp election

Choosing the S Corporation designation is particularly beneficial in several scenarios:

- Small to medium-sized businesses: Enterprises with fewer than 100 shareholders that are not seeking foreign investment often find this structure appealing. The pass-through taxation can lead to significant tax savings, especially for companies with high net income distributed to shareholders.

- Family businesses: Businesses operated by family members are ideal candidates due to their typically smaller shareholder base, simplifying compliance and governance.

- Service-oriented businesses: Service businesses that can efficiently balance distribution of profits and wages benefit from the straightforward tax implications and reduced self-employment taxes. Owners can pay themselves a reasonable salary, reducing their tax burden through dividends, which are not subject to self-employment tax, unlike their salary.

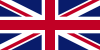

Step-by-step guide to choosing between C Corp and S Corp

Here is a comprehensive step-by-step guide to aid in making an informed decision when selecting between a C Corporation and an S Corporation.

Explore a comprehensive guide to select between a C Corporation and an S Corporation

1. Analyzing business goals and needs

- Growth objectives: Consider the scale and scope of your business plan. C Corps are often favored by startups intending to raise substantial capital due to unlimited shareholder potential and the ability to issue multiple classes of stock, appealing to venture capitalists. In contrast, S Corps are more suited for businesses prioritizing operational simplicity and smaller ownership groups, given their limitation to 100 shareholders and single-class stock structure.

- Liability protection: Both C Corps and S Corps provide limited liability protection, shielding personal assets from business liabilities. Assess the level of risk exposure in your industry - this protection might be more critical for businesses in high-liability sectors.

- Operational structure: Evaluate the complexity you're prepared to handle. C Corps require more formalities such as board meetings and stringent record-keeping, aligning with a structured growth trajectory. S Corps offer operational simplicity, with benefits like pass-through taxation, which might align better with smaller or closely-held businesses.

2. Understanding tax preferences and implications

- Corporate taxation: C Corps face double taxation - profits are taxed at the corporate level and dividends are taxed again at the shareholder level.

- Pass-through taxation: S Corps pass profits and losses directly to shareholders for federal tax purposes, avoiding double taxation.

- State tax considerations: Some states impose their own taxes on S Corps, while others might not recognize S Corp status.

3. Decision-making checklist for startups

Let’s explore the essential factors that startups should consider when making critical business decisions. A well-structured decision-making checklist can help founders navigate challenges, minimize risks, and set a strong foundation for growth.

- Evaluate eligibility:

- For S Corps: Limited to 100 U.S. shareholders, no foreign shareholders, one class of stock.

- Ensure alignment with IRS eligibility criteria and state regulations.

- Understand formation and compliance costs:

- Initial formation costs may be higher for C Corps due to registration, legal, and administrative expenses.

- Consider ongoing compliance costs like annual reporting and state franchise taxes.

- Assess ownership and exit strategy:

- C Corps offer greater flexibility and appeal for shareholder diversity and future public offerings.

- S Corps are limited but beneficial for those seeking simplified governance and no immediate plans for public trading.

- Prepare for payroll and self-employment taxes:

- S Corp owners reduce self-employment tax by paying themselves salaries, but need to adhere to the IRS's reasonable compensation rule.

- Consider how payroll taxes will impact your bottom line and personal finances.

By meticulously analyzing these aspects, businesses can choose the corporate structure that aligns with their strategic objectives and offers the most advantageous path forward. It's advisable to consult experts in legal and tax fields to tailor decisions to specific needs.

State-specific considerations for C Corp and S Corp

In this section, let’s explore the variations in state-level regulations, state franchise taxes, and incorporation and compliance costs across different states.

Variations in state-level regulations

State-level regulations vary significantly, affecting both C Corps and S Corps differently. These variations can include differences in filing requirements, annual reporting, and compliance obligations. Some states may require more rigorous compliance standards or additional filings, which can influence the overall business strategy.

- Filing requirements: Each state has its own requirements regarding the documents needed for incorporation. For example, while most states require the filing of Articles of Incorporation, others may demand the submission of a Certificate of Formation or an Organization Certificate. The terminology and details required within these documents can thus differ.

- Annual reporting: The frequency and nature of required annual reports can also vary. Some states demand more detailed disclosures about business operations and financials, which can impact both administrative workload and strategic business transparency.

- Compliance obligations: There might be specific state regulations concerning corporate governance, such as the number of required board meetings or specific organizational structures, which businesses must adhere to.

These regulations underscore the importance of consulting with legal or corporate experts familiar with the local legislative landscape in their respective states to ensure compliance and avoid legal pitfalls.

State franchise taxes and their impact

State franchise taxes are a crucial consideration, as they can significantly affect the financial obligations of both C Corps and S Corps. While franchise taxes are not universal across all states, they are levied on corporations for the privilege of doing business in a particular state, regardless of income generated.

- Tax calculation: States use different methods to calculate franchise taxes. Some use total revenue as the basis, while others calculate it based on net worth or capital employed in the state. This discrepancy can make a significant difference in tax liabilities.

- Exemptions and incentives: Certain states offer incentives or exemptions to small businesses, which can vary between C Corps and S Corps. States like Delaware, for instance, are popular for incorporation due to favorable tax laws that might exempt smaller or out-of-state businesses from some franchise taxes.

Understanding the nuances of state franchise taxes can aid in effective financial planning and resource allocation, ultimately impacting the decision on whether to file as a C Corp or S Corp.

Frequently asked questions about C Corps and S Corps

Here is a deep dive into some of the most frequently asked questions about these two forms of business between C Corporations and S Corporations.

What are the tax benefits of an S Corp vs a C Corp?

- S Corp: Avoids double taxation by passing income to shareholders, potentially lowering tax rates. Owners can also reduce self-employment taxes by splitting income into salary and distributions.

- C Corp: Faces double taxation but benefits from retained earnings at corporate tax rates and better deductions for fringe benefits.

How does double taxation work for C Corporations?

Double taxation is a pivotal tax consideration unique to C Corporations. Here's how it functions:

- Corporate level taxation: A C Corp is recognized as a separate tax entity by the IRS. It must file a corporate tax return (Form 1120) and pay taxes on its taxable income at the corporate tax rate.

- Shareholder level taxation: After the corporation pays its taxes and distributes dividends to shareholders, shareholders must report these dividends as income on their personal tax returns.

This tax system is central to understanding a C Corp's financial planning and can significantly affect cash flows and shareholder returns.

What are the main disadvantages of an S Corporation?

While S Corps provide several advantages, they come with specific disadvantages that can impact their suitability for certain businesses:

- Ownership restrictions: S Corporations are limited to 100 shareholders, and those shareholders must be U.S. citizens or residents, restricting foreign investments. The entity cannot have multiple classes of stock, potentially limiting its flexibility in raising capital.

- Compliance and administrative burden: Though simpler than C Corporations, S Corps still face strict compliance requirements. They must adhere to various operational formalities, such as scheduled shareholder meetings and detailed record-keeping, akin to traditional corporation standards.

- Employment tax obligations: While S Corps provide a self-employment tax savings opportunity, the IRS mandates that shareholders receive a "reasonable salary" for services rendered before distributions.

Common misconceptions and mistakes to avoid

Missteps not only complicate legal compliance but also impact a company's financial health and strategic direction. Here's a deep dive into common misconceptions and mistakes to avoid, ensuring optimized decision-making and execution.

Misunderstanding shareholder eligibility rules

A common misconception is that S Corps can have unlimited or foreign shareholders, but IRS rules restrict them to 100 shareholders, all of whom must be U.S. citizens or residents. Additionally, S Corps can issue only one class of stock, limiting flexibility in structuring voting rights and dividend preferences, which can be a drawback for businesses seeking diverse investors.

In contrast, C Corps offer greater flexibility, allowing unlimited shareholders, including foreign investors, and multiple stock classes with varying rights and privileges. This makes them a preferred choice for startups aiming for international expansion or venture capital funding, as they can accommodate sophisticated investors with tailored investment structures.

Overlooking state-specific tax considerations

While federal tax obligations for C Corps and S Corps are well-established, state tax regulations can create significant differences in a company’s financial outcome. Furthermore, some states do not recognize S Corp status, resulting in double taxation similar to C Corps. As businesses expand or relocate, they must thoroughly examine state-specific tax policies, as these can heavily influence the overall viability of operating as an S Corp or C Corp.

Conflating LLCs with S Corporations

LLCs (Limited Liability Company) and S Corporations are often confused, but they have key differences. Both offer pass-through taxation, but LLCs allow unlimited owners, including foreign individuals, and offer greater flexibility in profit distribution. Unlike S Corps, LLCs aren’t restricted to a single class of ownership, making them ideal for businesses seeking diverse investors. Understanding these distinctions is crucial to selecting the right structure for growth and compliance.

If you are still wondering about LLC and Corporations, let dive into the comparison LLCs vs Corporations

In conclusion, the decision between a C Corporation and an S Corporation demands thorough consideration of your business's unique needs, tax obligations, and growth plans. By leveraging professional guidance and staying informed through reliable resources, businesses can align their corporate structure with their strategic objectives effectively.

The US offers a welcoming environment for foreign investors with policies designed to benefit new businesses. If you are considering setting up an offshore company, G2B is here to help! As a professional business support service provider, G2B offers offshore company formation services in Delaware. Let us guide you through the entire process - Reach out to G2B today and take the next step toward expanding business internationally!

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  Ras Al Khaimah (UAE)

Ras Al Khaimah (UAE)  United Kingdom

United Kingdom